Hospital Services Size

Hospital Services Market Growth Projections and Opportunities

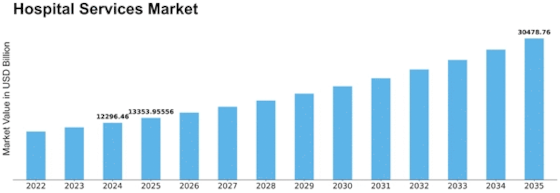

Hospital services Market size is expected to reach USD 21906 billion by 2032 at 8.6% CAGR. There are various factors that influence the growth and development of the Hospital Services Market. Hospitals offer medical, diagnostic, therapeutic, and support services. Such market forces as changes in population demographics, technological advancement in medicine, regulatory aspects, change in healthcare delivery systems and patient-centered care determine its character.

The market for hospital services is influenced by population growth; aging population; and prevalence of diseases. This necessitates diversification of hospital offerings due to burgeoning populations plus an aging demographic. Chronic illness rates coupled with non-communicable ailments make the demand for hospitals’ relevantness even more obvious thus impacting their range as well as complexity of their offering with respect to the variety of patient needs within a changing health care system.

Medical technology has a huge impact on hospital service markets. Diagnostic imaging technology in hospitals is known for being a major source of revenue while other technologies such as telemedicine information systems help hospitals provide more accurate services to patients who require them at different times when they visit these institutions. Adopting new technologies improves diagnosis & treatment resulting into better healthcare outcome among them all. These innovations must be integrated into hospitals to be competitive and meet patient expectations as well as those from doctors who are part of the healthcare team.

Another important market issue is hospital and healthcare system competition. Hospitals compete to attract patients, medical professionals, or capture more market share through developing better health facilities for specialized treatments by utilizing new technologies that may help them achieve an improved patient experience while enhancing innovation. This enhances access and quality of health services in the Hospital Services Market.

Economic aspects also affect hospital service market dynamics. During economic downturns there will be cost-conscious healthcare procurement which might impact on a Hospital's finances & investments while making its treatment affordable to both consumers & other healthcare institutions depending upon prevailing economic conditions when it comes to healthcare spending thus making these treatments affordable and accessible within various communities as they seek to balance their books during lean times. However, when economy booms healthcare spending increases leading to technological improvements in hospitals including expansion.

Leave a Comment