Growing Electric Vehicle Adoption

The growing adoption of electric vehicles (EVs) is emerging as a vital driver for the High Voltage Cables & Accessories Market. As the automotive sector shifts towards electrification, the demand for charging infrastructure is escalating. High voltage cables are essential for connecting charging stations to the power grid, ensuring efficient energy transfer. Recent statistics suggest that the number of EVs on the road is expected to rise dramatically, prompting investments in charging networks. This trend not only supports the transition to sustainable transportation but also creates new opportunities for high voltage cable manufacturers to cater to the evolving energy landscape.

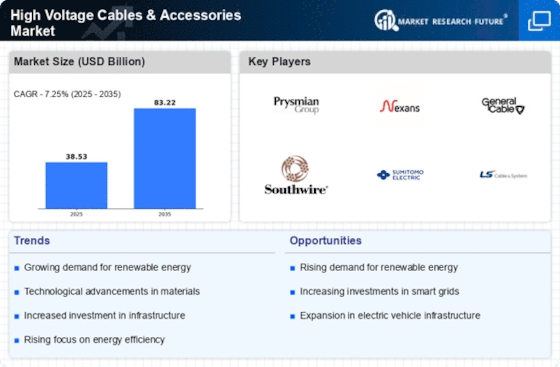

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is a pivotal driver for the High Voltage Cables & Accessories Market. As countries strive to meet energy transition goals, the demand for high voltage cables is expected to surge. For instance, the International Energy Agency projects that renewable energy capacity will grow significantly, necessitating robust transmission systems. High voltage cables are essential for transporting electricity from remote renewable sources, such as wind and solar farms, to urban centers. This trend indicates a potential market expansion, as investments in renewable infrastructure are likely to increase, thereby enhancing the demand for high voltage cables and accessories.

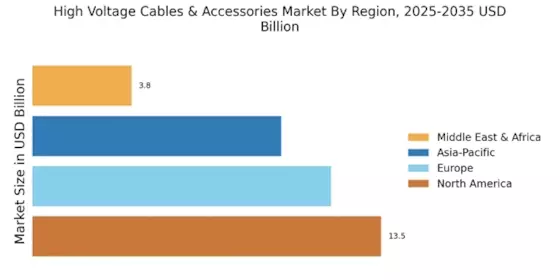

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are crucial factors influencing the High Voltage Cables & Accessories Market. As urban areas expand, the need for reliable electricity supply becomes paramount. According to recent data, urban populations are projected to rise, leading to increased energy consumption. This scenario necessitates the installation of high voltage cables to support the growing energy demands of cities. Furthermore, infrastructure projects, including transportation and smart city initiatives, require advanced electrical systems, further driving the market. The integration of high voltage cables in these projects is likely to enhance efficiency and reliability in energy distribution.

Government Investments in Energy Infrastructure

Government investments in energy infrastructure are a significant driver for the High Voltage Cables & Accessories Market. Many governments are prioritizing the modernization of electrical grids to enhance reliability and accommodate renewable energy sources. For instance, substantial funding is being allocated to upgrade transmission lines and expand grid capacity. This trend is likely to create a favorable environment for high voltage cable manufacturers, as increased infrastructure spending translates into higher demand for cables and accessories. The commitment to improving energy infrastructure indicates a robust growth trajectory for the market in the coming years.

Technological Innovations in Cable Manufacturing

Technological innovations in cable manufacturing are transforming the High Voltage Cables & Accessories Market. Advances in materials science and engineering have led to the development of cables that are lighter, more durable, and capable of handling higher voltages. For example, the introduction of cross-linked polyethylene (XLPE) insulation has improved the performance and longevity of high voltage cables. These innovations not only enhance the efficiency of power transmission but also reduce maintenance costs. As manufacturers adopt these cutting-edge technologies, the market is expected to witness a shift towards more efficient and reliable high voltage cable solutions.