Rising Infrastructure Investments

The Medium Voltage Cables Market is experiencing a surge in infrastructure investments, particularly in developing regions. Governments and private entities are allocating substantial funds to enhance power distribution networks, which is crucial for economic growth. For instance, the International Energy Agency indicates that investments in electricity infrastructure are projected to reach trillions of dollars over the next decade. This trend is likely to drive demand for medium voltage cables, as they are essential for connecting substations to end-users. Furthermore, the expansion of urban areas necessitates the installation of robust electrical systems, further propelling the market. As cities grow, the need for reliable power supply becomes paramount, thus creating a favorable environment for medium voltage cables.

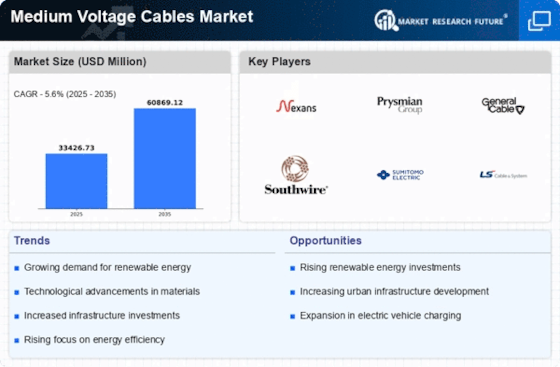

Expansion of Renewable Energy Projects

The Medium Voltage Cables Market is significantly influenced by the expansion of renewable energy projects. As countries strive to meet sustainability goals, investments in wind, solar, and hydroelectric power are increasing. According to recent data, renewable energy sources are expected to account for a substantial share of the global energy mix by 2035. This shift necessitates the use of medium voltage cables to connect renewable energy generation sites to the grid. The integration of these cables is vital for efficient energy transmission and distribution, ensuring that renewable energy can be effectively utilized. Consequently, the growth of renewable energy projects is likely to bolster the demand for medium voltage cables, as they play a critical role in modern energy infrastructure.

Growing Urbanization and Electrification

The Medium Voltage Cables Market is closely linked to the trends of urbanization and electrification. As populations migrate to urban areas, the demand for electricity rises sharply. This urban growth necessitates the expansion of electrical infrastructure, including medium voltage cables, to ensure that power supply meets the increasing demand. Data suggests that urban areas are expected to house over two-thirds of the world's population by 2050, leading to unprecedented pressure on existing power systems. Consequently, utility companies are investing in upgrading and expanding their networks, which includes the installation of medium voltage cables. This trend is likely to create a robust market for medium voltage cables as cities evolve and require more sophisticated electrical solutions.

Regulatory Support for Energy Efficiency

The Medium Voltage Cables Market is positively impacted by regulatory support aimed at enhancing energy efficiency. Governments worldwide are implementing policies that promote the use of energy-efficient technologies, including advanced cable systems. These regulations often mandate the adoption of medium voltage cables that meet specific performance standards, thereby driving market growth. For instance, energy efficiency programs are being established to incentivize the replacement of outdated electrical systems with modern solutions. This regulatory environment encourages investments in medium voltage cables, as they are integral to achieving energy efficiency goals. As such, the alignment of regulatory frameworks with market needs is likely to foster a conducive atmosphere for the medium voltage cables market.

Technological Innovations in Cable Design

The Medium Voltage Cables Market is benefiting from technological innovations in cable design and manufacturing processes. Advances in materials science have led to the development of cables that are lighter, more durable, and capable of withstanding higher temperatures. These innovations not only enhance the performance of medium voltage cables but also reduce installation and maintenance costs. For example, the introduction of cross-linked polyethylene (XLPE) insulation has improved the thermal and electrical properties of cables, making them more efficient. As industries seek to optimize their electrical systems, the demand for technologically advanced medium voltage cables is likely to increase. This trend indicates a shift towards more efficient and reliable power distribution solutions.