Market Growth Projections

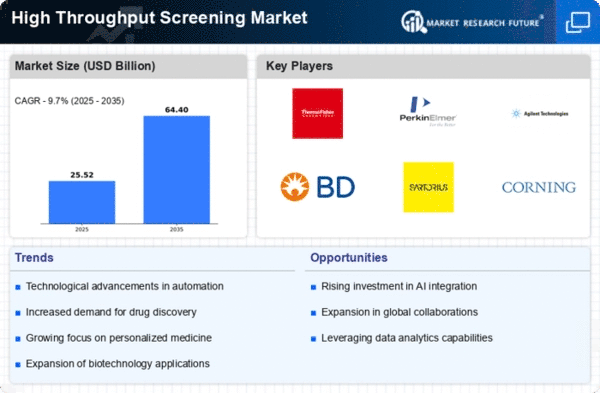

The Global High Throughput Screening Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 64.4 USD Billion by 2035, the industry is poised for a transformative phase. This growth is underpinned by a compound annual growth rate of 9.7% from 2025 to 2035, reflecting the increasing adoption of high throughput screening technologies across various sectors, including pharmaceuticals, biotechnology, and academic research. The expansion of research initiatives and the rising demand for efficient drug discovery processes are likely to drive this upward trajectory, positioning high throughput screening as a cornerstone of modern biomedical research.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global High Throughput Screening Market Industry. Innovations in automation, robotics, and data analysis are enhancing the capabilities of high throughput screening systems. For instance, the integration of artificial intelligence and machine learning algorithms is enabling more accurate predictions of compound behavior, thereby streamlining the screening process. These advancements not only improve throughput but also reduce costs, making high throughput screening more accessible to smaller research institutions. As a result, the market is poised for substantial growth, with a projected compound annual growth rate of 9.7% from 2025 to 2035, reflecting the ongoing evolution of screening technologies.

Rising Demand for Drug Discovery

The Global High Throughput Screening Market Industry experiences a surge in demand driven by the increasing need for efficient drug discovery processes. Pharmaceutical companies are increasingly adopting high throughput screening technologies to expedite the identification of potential drug candidates. This trend is underscored by the industry's projected growth, with the market expected to reach 23.3 USD Billion in 2024. As the complexity of diseases rises, the ability to screen thousands of compounds simultaneously becomes crucial, thereby enhancing the overall efficiency of drug development. Consequently, this demand is likely to propel the market forward, fostering innovation and investment in high throughput screening technologies.

Regulatory Support and Initiatives

Regulatory support and initiatives are crucial drivers of the Global High Throughput Screening Market Industry. Governments and regulatory bodies are increasingly recognizing the importance of high throughput screening in accelerating drug development and ensuring safety and efficacy. Initiatives aimed at streamlining regulatory processes for new drug approvals are encouraging pharmaceutical companies to adopt high throughput screening technologies. This supportive environment is likely to enhance market growth, as it reduces barriers to entry for innovative screening solutions. As the industry evolves, regulatory frameworks may continue to adapt, further promoting the integration of high throughput screening in drug discovery and development.

Growing Focus on Personalized Medicine

The Global High Throughput Screening Market Industry is increasingly aligned with the growing focus on personalized medicine. As healthcare shifts towards tailored therapeutic approaches, high throughput screening technologies are essential for identifying specific biomarkers and drug responses in diverse patient populations. This alignment is fostering collaborations between pharmaceutical companies and academic institutions, enhancing the development of targeted therapies. The market's growth trajectory reflects this trend, as it is expected to reach 23.3 USD Billion in 2024. Personalized medicine not only improves patient outcomes but also drives the demand for high throughput screening, as it allows for the efficient evaluation of drug efficacy across various genetic backgrounds.

Increasing Investment in Biotechnology

The Global High Throughput Screening Market Industry is significantly influenced by the rising investment in biotechnology research and development. Governments and private entities are channeling funds into biopharmaceutical research, which necessitates the use of high throughput screening technologies for efficient candidate selection. This influx of capital is expected to drive the market's expansion, as it enables the development of novel therapeutics and personalized medicine approaches. The market is projected to grow to 64.4 USD Billion by 2035, indicating a robust interest in biotechnology that is likely to sustain demand for high throughput screening solutions. This trend underscores the critical role of high throughput screening in advancing biotechnological innovations.