Rising Demand for Drug Discovery

The high throughput-screening market is experiencing a notable surge in demand driven by the increasing need for efficient drug discovery processes. Pharmaceutical companies are under pressure to reduce time-to-market for new drugs, which has led to a greater reliance on high throughput screening technologies. In the US, the market for drug discovery is projected to reach approximately $50 billion by 2026, with high throughput screening playing a pivotal role in this growth. The ability to rapidly test thousands of compounds against biological targets allows researchers to identify potential drug candidates more efficiently. This trend is further supported by the growing prevalence of chronic diseases, necessitating innovative therapeutic solutions. As a result, the high throughput-screening market is positioned to expand significantly, catering to the evolving needs of the pharmaceutical industry.

Growing Focus on Genomic Research

The high throughput-screening market is significantly influenced by the growing focus on genomic research, which aims to understand the genetic basis of diseases. As genomic technologies advance, the need for high throughput screening methods to analyze large datasets becomes increasingly apparent. In the US, the genomic research market is projected to grow at a CAGR of over 10% through 2027, indicating a robust demand for high throughput screening solutions. These technologies enable researchers to conduct large-scale analyses of gene functions and interactions, facilitating the identification of novel drug targets. Consequently, the high throughput-screening market is poised to expand as it aligns with the objectives of genomic research, providing essential tools for researchers in the field.

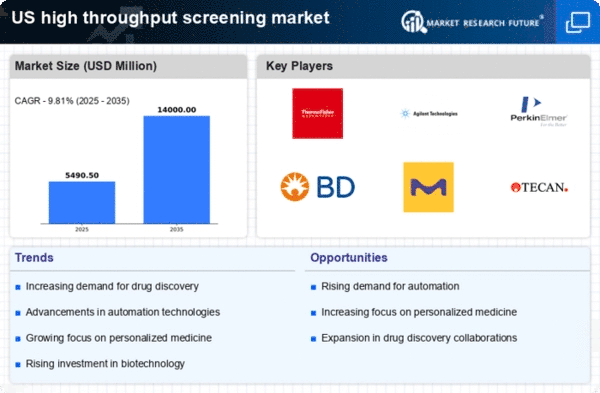

Increased Investment in Biotechnology

Investment in biotechnology is a critical driver for the high throughput-screening market, as it fuels innovation and development in drug discovery and development processes. In the US, venture capital funding for biotech firms has seen a substantial increase, with investments exceeding $20 billion in recent years. This influx of capital enables companies to adopt advanced high throughput screening technologies, enhancing their research capabilities. Furthermore, the US government has also been supportive of biotechnology initiatives, providing grants and funding opportunities that encourage the adoption of high throughput screening methods. As biotechnology continues to evolve, the high throughput-screening market is likely to benefit from these investments, leading to improved efficiency and effectiveness in drug development.

Regulatory Support for Innovative Technologies

Regulatory support for innovative technologies is a vital driver for the high throughput-screening market, as it fosters an environment conducive to research and development. In the US, regulatory agencies such as the FDA are increasingly recognizing the importance of high throughput screening in expediting the drug approval process. Initiatives aimed at streamlining regulatory pathways for innovative screening technologies are being implemented, which could potentially reduce the time and costs associated with bringing new drugs to market. This supportive regulatory framework encourages pharmaceutical companies to invest in high throughput screening methods, thereby driving market growth. As regulatory bodies continue to adapt to the evolving landscape of drug discovery, the high throughput-screening market is likely to benefit from enhanced acceptance and integration of these technologies.

Emergence of Artificial Intelligence in Screening

The integration of artificial intelligence (AI) into the high throughput-screening market is transforming the landscape of drug discovery. AI technologies are being utilized to analyze vast amounts of screening data, improving the accuracy and speed of identifying potential drug candidates. In the US, the adoption of AI in drug discovery is expected to grow significantly, with estimates suggesting that AI-driven drug discovery could reduce costs by up to 30%. This technological advancement not only enhances the efficiency of high throughput screening processes but also allows for more informed decision-making in the selection of compounds for further development. As AI continues to evolve, its impact on the high throughput-screening market is likely to be profound, driving innovation and improving outcomes in drug discovery.