Rising Demand for Drug Discovery

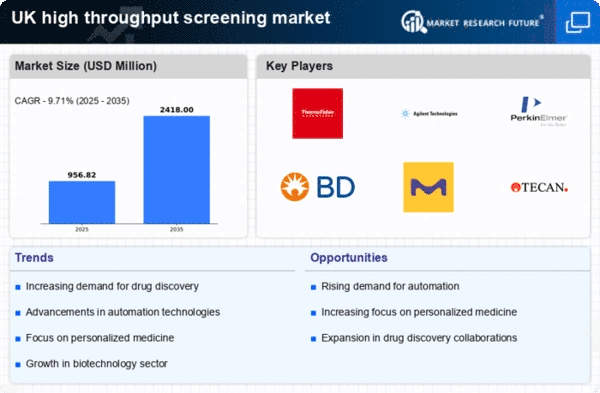

The high throughput-screening market is experiencing a notable surge in demand driven by the increasing need for efficient drug discovery processes. Pharmaceutical companies in the UK are under pressure to accelerate the development of new therapeutics, particularly in the face of rising healthcare costs. This has led to a greater reliance on high throughput screening technologies, which enable the rapid testing of thousands of compounds. According to recent estimates, the UK pharmaceutical sector is projected to invest over £1 billion in drug discovery technologies by 2026. This investment is likely to enhance the capabilities of high throughput screening, making it a pivotal component in the drug development pipeline.

Growing Focus on Genomic Research

The high throughput-screening market is being propelled by a growing focus on genomic research and personalized medicine. As researchers in the UK increasingly recognize the importance of genetic factors in disease, there is a heightened demand for screening technologies that can analyze genetic variations. This trend is reflected in the substantial funding allocated to genomic research initiatives, with the UK government committing over £500 million to genomics in recent years. Such investments are expected to drive advancements in high throughput screening methodologies, facilitating the identification of targeted therapies based on genetic profiles.

Increased Investment in Biotechnology

The high throughput-screening market is benefiting from increased investment in the biotechnology sector within the UK. As biopharmaceutical companies seek to innovate and develop novel therapies, they are allocating substantial resources towards advanced screening technologies. Reports indicate that the UK biotechnology sector attracted over £2 billion in venture capital funding in 2025, a clear indication of the growing confidence in biopharmaceutical innovation. This influx of capital is likely to enhance the capabilities of high throughput screening, enabling more comprehensive and efficient screening processes that can lead to breakthrough therapies.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into the high throughput-screening market is transforming the landscape of drug discovery and development. AI technologies are being employed to analyze vast datasets generated during screening processes, thereby improving the accuracy and efficiency of identifying potential drug candidates. In the UK, the adoption of AI in life sciences is expected to grow at a CAGR of approximately 30% over the next five years. This trend suggests that AI will play a crucial role in optimizing high throughput screening workflows, ultimately leading to faster and more cost-effective drug development.

Collaboration Between Academia and Industry

The high throughput screening market is witnessing a surge in collaborations between academic institutions and industry players in the UK. These partnerships are fostering innovation and facilitating the transfer of knowledge and technology. Universities are increasingly engaging with pharmaceutical companies to develop novel screening methods and share resources. This collaborative approach is likely to enhance the capabilities of high throughput screening, as academic research often leads to breakthroughs that can be translated into practical applications. The UK government has also recognized the importance of these collaborations, providing funding to support joint research initiatives.