Emergence of IoT Applications

The rapid emergence of Internet of Things (IoT) applications is reshaping the landscape of the High Speed Data Converter Market. IoT devices, which often require real-time data processing and transmission, rely heavily on high-speed data converters to function effectively. The number of connected IoT devices is anticipated to reach billions, creating a substantial demand for efficient data conversion solutions. This trend suggests that manufacturers will need to focus on developing converters that can handle diverse data formats and high-speed requirements, thereby enhancing their market position and driving growth.

Advancements in Consumer Electronics

The proliferation of consumer electronics equipped with high-speed data processing capabilities significantly influences the High Speed Data Converter Market. Devices such as smartphones, tablets, and gaming consoles increasingly require high-performance data converters to support advanced functionalities. Market data indicates that the consumer electronics sector is projected to witness substantial growth, with a compound annual growth rate (CAGR) of over 6% in the coming years. This surge in demand for high-quality audio and video experiences drives manufacturers to innovate and integrate high-speed data converters, thereby fostering market expansion.

Growing Automotive Electronics Sector

The automotive electronics sector is experiencing significant growth, which is positively impacting the High Speed Data Converter Market. With the rise of electric vehicles and advanced driver-assistance systems (ADAS), the demand for high-speed data converters is on the rise. These converters are essential for processing data from various sensors and communication systems within vehicles. Market analysis indicates that the automotive electronics market is expected to grow at a CAGR of approximately 7% over the next few years, further emphasizing the need for high-performance data converters to support innovative automotive technologies.

Increased Focus on Industrial Automation

The trend towards industrial automation is a key driver for the High Speed Data Converter Market. As industries adopt smart manufacturing practices, the need for precise and rapid data conversion becomes paramount. High-speed data converters facilitate real-time monitoring and control of industrial processes, enhancing operational efficiency. Market forecasts suggest that the industrial automation sector will continue to expand, with investments in automation technologies increasing significantly. This growth is likely to create a robust demand for high-speed data converters, as they are integral to the successful implementation of automated systems.

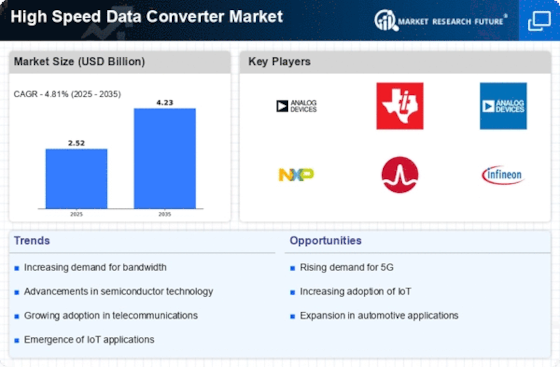

Rising Demand for High-Speed Communication

The increasing demand for high-speed communication systems is a primary driver for the High Speed Data Converter Market. As industries such as telecommunications and data centers expand, the need for faster data transmission becomes critical. According to recent estimates, the data traffic is expected to grow exponentially, necessitating advanced data converters that can handle higher bandwidths. This trend is particularly evident in 5G networks, where high-speed data converters play a crucial role in ensuring efficient signal processing. The integration of these converters into communication infrastructure is likely to enhance overall system performance, thereby propelling market growth.