Technological Advancements

The Global High-Speed Engine Market Industry is witnessing rapid technological advancements that enhance engine performance and efficiency. Innovations such as advanced materials and precision manufacturing techniques are being integrated into high-speed engines, resulting in improved power-to-weight ratios and reduced emissions. For instance, the adoption of lightweight composite materials has led to engines that are not only faster but also more fuel-efficient. This trend is likely to drive the market's growth, as manufacturers seek to meet stringent environmental regulations while maximizing performance. As a result, the market is projected to reach 7.16 USD Billion in 2024, reflecting the industry's commitment to innovation.

Expansion of Aerospace Sector

The Global High-Speed Engine Market Industry is experiencing growth due to the expansion of the aerospace sector. As air travel demand increases, there is a corresponding need for high-speed engines that can power next-generation aircraft. Innovations in engine design and efficiency are critical for meeting the performance requirements of modern aviation. The aerospace industry is actively investing in high-speed engine technologies to enhance fuel efficiency and reduce operational costs. This trend is expected to contribute to the market's growth, with projections indicating a robust increase in demand for high-speed engines in the coming years, aligning with the overall expansion of the aerospace sector.

Emerging Markets and Globalization

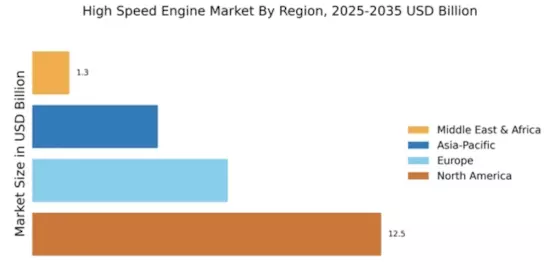

The Global High-Speed Engine Market Industry is being propelled by the emergence of new markets and the effects of globalization. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization, leading to increased demand for high-speed engines in various applications, including transportation and manufacturing. This trend is further supported by global supply chains that facilitate the distribution of high-speed engine technologies across borders. As these emerging markets continue to develop, they are likely to contribute significantly to the market's growth. The anticipated increase in market value to 12.3 USD Billion by 2035 reflects the potential of these regions to drive demand for advanced engine solutions.

Regulatory Support for Clean Energy Solutions

The Global High-Speed Engine Market Industry is benefiting from regulatory support aimed at promoting clean energy solutions. Governments worldwide are implementing policies that encourage the development and adoption of high-speed engines with lower emissions. This regulatory environment is fostering innovation and investment in cleaner technologies, as manufacturers strive to comply with environmental standards. For example, initiatives aimed at reducing carbon footprints are pushing engine developers to create more efficient designs. The anticipated growth of the market, with a projected CAGR of 5.04% from 2025 to 2035, underscores the potential for high-speed engines to play a pivotal role in the transition to sustainable energy solutions.

Increasing Demand for High-Performance Vehicles

The Global High-Speed Engine Market Industry is significantly influenced by the rising demand for high-performance vehicles across various segments, including automotive and aerospace. Consumers are increasingly seeking vehicles that offer superior speed and efficiency, prompting manufacturers to invest in high-speed engine technologies. This trend is evident in the automotive sector, where luxury and sports car manufacturers are incorporating high-speed engines to enhance driving experiences. The market is expected to grow substantially, with projections indicating a value of 12.3 USD Billion by 2035. This demand is further fueled by the growing popularity of motorsports, which showcases the capabilities of high-speed engines.