Growth in Renewable Energy Sector

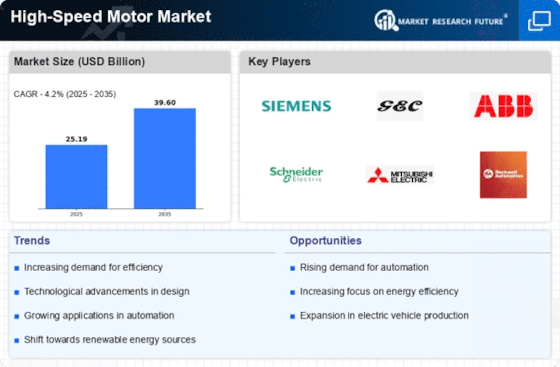

The High-Speed Motor Market is benefiting from the growth in the renewable energy sector. As the world increasingly turns to sustainable energy sources, high-speed motors are being employed in various applications, including wind turbines and solar energy systems. These motors play a crucial role in enhancing the efficiency and reliability of renewable energy generation. Recent reports suggest that the renewable energy market is expected to witness substantial growth, with investments in wind and solar energy projected to reach unprecedented levels. This trend is likely to create new opportunities for high-speed motor manufacturers, as the demand for efficient and reliable motors in renewable energy applications continues to rise, thereby bolstering the High-Speed Motor Market.

Rising Demand for Energy Efficiency

The High-Speed Motor Market is experiencing a notable surge in demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, high-speed motors, which offer superior efficiency compared to traditional motors, are becoming increasingly attractive. According to recent data, energy-efficient motors can reduce energy consumption by up to 30%, which is a compelling incentive for manufacturers. This trend is particularly evident in sectors such as manufacturing and transportation, where energy costs constitute a significant portion of operational expenses. The push for energy efficiency is likely to drive innovation and investment in high-speed motor technologies, further propelling the growth of the High-Speed Motor Market.

Expansion of Electric Vehicle Market

The High-Speed Motor Market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. As the automotive industry shifts towards electrification, high-speed motors are increasingly utilized in electric drivetrains, providing the necessary power and efficiency for modern vehicles. Recent statistics indicate that the EV market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to create substantial demand for high-speed motors, as manufacturers seek to enhance vehicle performance and range. The integration of high-speed motors in EVs not only improves efficiency but also contributes to the overall sustainability goals of the automotive sector, thereby reinforcing the significance of the High-Speed Motor Market.

Technological Innovations in Motor Design

Technological advancements in motor design are significantly influencing the High-Speed Motor Market. Innovations such as improved materials, advanced cooling techniques, and sophisticated control systems are enhancing the performance and reliability of high-speed motors. For instance, the introduction of lightweight materials can reduce the overall weight of motors, leading to better efficiency and performance. Furthermore, the development of smart motors equipped with IoT capabilities allows for real-time monitoring and predictive maintenance, which can reduce downtime and operational costs. These innovations are likely to attract investments and drive competition within the High-Speed Motor Market, as companies strive to offer cutting-edge solutions that meet the evolving needs of various applications.

Increased Automation in Industrial Processes

The High-Speed Motor Market is experiencing growth driven by the increased automation of industrial processes. As industries seek to enhance productivity and reduce labor costs, the adoption of automated systems is becoming more prevalent. High-speed motors are integral to these systems, providing the necessary speed and torque for various applications, including robotics and conveyor systems. Data indicates that the automation market is expected to grow significantly, with many industries investing in advanced technologies to streamline operations. This trend is likely to create a robust demand for high-speed motors, as manufacturers look for solutions that can improve efficiency and performance in automated environments, thereby reinforcing the importance of the High-Speed Motor Market.