North America : Market Leader in Innovation

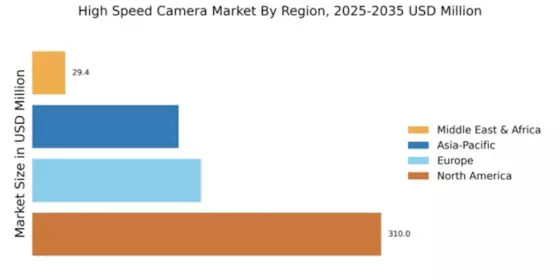

North America continues to lead the high speed camera market, holding a significant share of 310.0 million in 2025. North America leads the high-speed camera market, with strong adoption of high speed cameras fps in research and entertainment. The region's growth is driven by advancements in technology, increasing demand from industries such as automotive and entertainment, and supportive regulatory frameworks. The presence of major players like Vision Research and IDT further fuels market expansion, as they innovate to meet diverse consumer needs.

The competitive landscape in North America is robust, with the U.S. being the primary market contributor. Companies like Nikon and Sony are investing heavily in R&D to enhance product offerings. The region's focus on high-quality imaging solutions and the integration of AI in camera technology are key trends. As industries seek faster and more efficient imaging solutions, North America is poised for sustained growth in this sector.

Europe : Emerging Market with Growth Potential

Europe's market is growing with demand for high speed video recording cameras in automotive and research applications. Europe's high speed camera market is valued at 150.0 million in 2025, reflecting a growing interest in high-speed imaging technologies across various sectors. The region benefits from stringent quality regulations and a strong emphasis on research and development, which drive innovation. Countries like Germany and the UK are at the forefront, with increasing investments in automotive testing and scientific research fueling demand for high speed cameras.

The competitive landscape in Europe features key players such as Basler AG and Olympus Corporation, who are leveraging advanced technologies to enhance their product lines. The market is characterized by collaborations between manufacturers and research institutions, fostering innovation. As European industries continue to adopt high-speed imaging for quality assurance and analysis, the market is expected to expand significantly.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific shows rapid expansion, driven by ultra high speed camera deployment in industrial and entertainment sectors. The Asia-Pacific region, with a market size of 130.0 million in 2025, is experiencing rapid growth in the high speed camera sector. This growth is attributed to increasing industrial automation, rising demand from the entertainment industry, and advancements in technology. Countries like Japan and China are leading the charge, with significant investments in high-speed imaging technologies to enhance production processes and quality control.

The competitive landscape is vibrant, featuring major players such as Photron and Nikon, who are expanding their market presence through innovative product offerings. The region's focus on technological advancements and the growing adoption of high-speed cameras in various applications, including sports and scientific research, are key drivers of market growth. As the demand for high-quality imaging solutions rises, Asia-Pacific is set to become a significant player in the global market.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region, with a market size of 29.36 million in 2025, presents emerging opportunities in the high speed camera market. MEA presents emerging opportunities for camera high speed solutions in infrastructure monitoring and oil & gas industries. The growth is driven by increasing investments in infrastructure and technology, particularly in sectors like oil and gas, where high-speed imaging is essential for monitoring and analysis. Regulatory support for technological advancements is also a catalyst for market growth in this region.

Countries such as South Africa and the UAE are leading the way in adopting high-speed imaging technologies. The competitive landscape is evolving, with local and international players vying for market share. As industries in the region recognize the value of high-speed cameras for enhancing operational efficiency, the market is expected to grow steadily, driven by both demand and innovation.