Growth in Specialty Chemicals

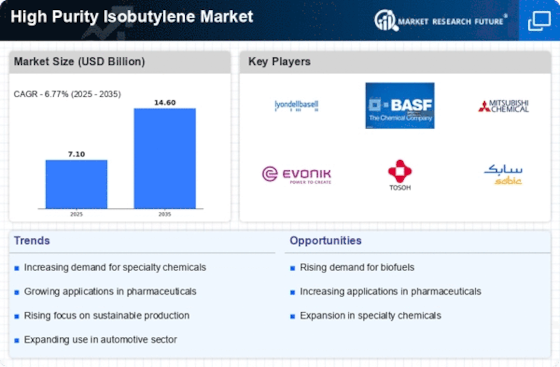

The High Purity Isobutylene Market is witnessing growth due to the rising demand for specialty chemicals. These chemicals, which require high purity levels for optimal performance, are increasingly utilized in various applications, including coatings, adhesives, and sealants. The specialty chemicals market has shown resilience and adaptability, with projections indicating a steady increase in demand. As manufacturers strive to produce high-performance products, the need for high purity isobutylene becomes more pronounced. This trend suggests that the High Purity Isobutylene Market may benefit from the expanding specialty chemicals sector, as companies seek to enhance product quality and meet evolving consumer expectations.

Expansion in the Pharmaceutical Sector

The pharmaceutical sector is emerging as a significant driver for the High Purity Isobutylene Market. The increasing utilization of isobutylene in the synthesis of active pharmaceutical ingredients (APIs) and other intermediates is noteworthy. As the pharmaceutical industry continues to expand, the demand for high purity isobutylene is likely to increase, driven by the need for high-quality compounds that meet rigorous safety and efficacy standards. Recent market analyses suggest that the pharmaceutical sector's growth could lead to a substantial uptick in isobutylene consumption, further solidifying its role in the High Purity Isobutylene Market. This trend indicates a shift towards more specialized applications, which may enhance the overall market landscape.

Rising Demand in Chemical Manufacturing

The High Purity Isobutylene Market is experiencing a notable surge in demand from the chemical manufacturing sector. This increase is primarily driven by the growing need for high-quality intermediates in the production of various chemicals, including butyl rubber and methyl methacrylate. As industries seek to enhance product performance and sustainability, the demand for high purity isobutylene is projected to rise. Recent data indicates that the chemical manufacturing sector accounts for a substantial portion of isobutylene consumption, with expectations of continued growth. This trend suggests that manufacturers are increasingly prioritizing high purity levels to meet stringent regulatory standards and consumer preferences, thereby bolstering the High Purity Isobutylene Market.

Regulatory Compliance and Quality Standards

Regulatory compliance and stringent quality standards are pivotal factors influencing the High Purity Isobutylene Market. As industries face increasing scrutiny regarding product safety and environmental impact, the demand for high purity isobutylene is likely to rise. Manufacturers are compelled to adhere to rigorous regulations, which necessitate the use of high-quality raw materials. This trend is particularly evident in sectors such as automotive and pharmaceuticals, where compliance with safety standards is paramount. The emphasis on quality assurance may drive companies to invest in high purity isobutylene, thereby enhancing its market presence. This regulatory landscape indicates a growing recognition of the importance of purity in the High Purity Isobutylene Market.

Technological Innovations in Production Processes

Technological innovations in production processes are significantly shaping the High Purity Isobutylene Market. Advances in purification techniques and production methodologies are enabling manufacturers to achieve higher purity levels more efficiently. These innovations not only enhance product quality but also reduce production costs, making high purity isobutylene more accessible to various industries. As technology continues to evolve, it is likely that the market will see an influx of new players and increased competition. This dynamic environment suggests that the High Purity Isobutylene Market may experience accelerated growth, driven by the continuous improvement of production technologies and the quest for higher purity standards.