Emerging Applications in Renewable Energy

The transition towards renewable energy sources is creating new opportunities for the High Purity Gas Market. Gases such as hydrogen are gaining traction as clean energy carriers, particularly in fuel cell technologies and energy storage systems. The growing emphasis on reducing carbon emissions and enhancing energy efficiency is likely to drive the demand for high purity hydrogen and other gases. As governments and industries invest in renewable energy infrastructure, the market for high purity gases is expected to expand. This shift not only supports environmental goals but also presents a lucrative avenue for suppliers in the High Purity Gas Market to innovate and diversify their product offerings.

Rising Demand from Semiconductor Industry

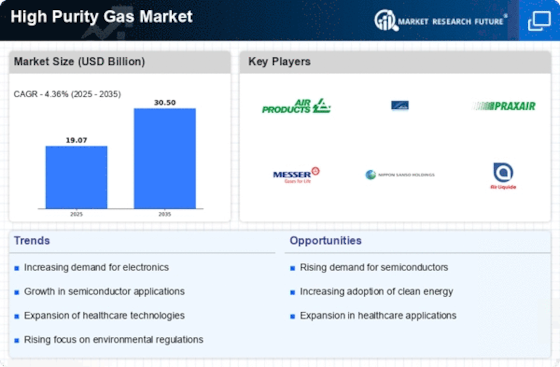

The semiconductor industry is a major driver for the High Purity Gas Market, as it requires ultra-pure gases for manufacturing processes. The increasing complexity of semiconductor devices necessitates the use of high purity gases, such as nitrogen, argon, and hydrogen, to ensure optimal performance and reliability. In recent years, the semiconductor market has expanded significantly, with a projected growth rate of around 7% annually. This growth is likely to propel the demand for high purity gases, as manufacturers seek to maintain stringent quality standards. Consequently, suppliers in the High Purity Gas Market are focusing on enhancing their production capabilities to meet this rising demand.

Regulatory Compliance and Quality Standards

The High Purity Gas Market is significantly influenced by stringent regulatory compliance and quality standards imposed by various governing bodies. These regulations ensure that high purity gases meet specific purity levels and safety requirements, particularly in critical applications such as aerospace, electronics, and healthcare. Companies are compelled to invest in advanced purification technologies and quality control measures to adhere to these standards. This trend is expected to drive market growth, as businesses that fail to comply may face penalties or loss of market access. The increasing focus on quality assurance is likely to enhance the overall credibility and reliability of the High Purity Gas Market.

Growth in Healthcare and Pharmaceutical Applications

The healthcare and pharmaceutical sectors are increasingly relying on high purity gases for various applications, including medical imaging, anesthesia, and laboratory processes. The High Purity Gas Market is benefiting from this trend, as the demand for gases like oxygen, nitrogen, and carbon dioxide continues to rise. With the pharmaceutical market expected to grow at a rate of approximately 5% annually, the need for high purity gases is likely to increase correspondingly. This growth is driven by the ongoing development of new drugs and therapies, which require precise gas compositions for effective results. As a result, suppliers are investing in advanced purification technologies to cater to the specific needs of these industries.

Technological Innovations in High Purity Gas Production

The High Purity Gas Market is experiencing a surge in technological innovations that enhance the efficiency and effectiveness of gas production processes. Advanced purification techniques, such as membrane separation and cryogenic distillation, are being adopted to achieve higher purity levels. These innovations not only improve product quality but also reduce operational costs. For instance, the implementation of automated systems in gas handling and monitoring has led to a significant decrease in contamination risks. As a result, the market is projected to grow at a compound annual growth rate of approximately 6% over the next five years, driven by the increasing demand for high purity gases in sectors like electronics and pharmaceuticals.