Expansion in Medical Applications

The Global Butyl Rubber Market Industry is witnessing an expansion in medical applications, particularly in the production of medical devices and pharmaceutical packaging. Butyl rubber's excellent barrier properties and biocompatibility make it an ideal material for these applications. As healthcare demands evolve, the need for reliable and safe packaging solutions is becoming increasingly critical. This trend indicates that the medical sector could significantly contribute to market growth, aligning with the overall projected CAGR of 3.66% from 2025 to 2035. The increasing focus on healthcare innovation is likely to bolster the demand for butyl rubber in this sector.

Increasing Environmental Regulations

The Global Butyl Rubber Market Industry is influenced by increasing environmental regulations that encourage the use of sustainable materials. As governments worldwide implement stricter regulations on emissions and waste, manufacturers are compelled to explore eco-friendly alternatives. Butyl rubber, with its potential for recycling and reduced environmental footprint, may gain traction in this context. This shift towards sustainability could drive innovation and investment in the butyl rubber sector, potentially leading to a market value of 5200 USD Million by 2035. The alignment of industry practices with regulatory frameworks may further enhance the market's growth prospects.

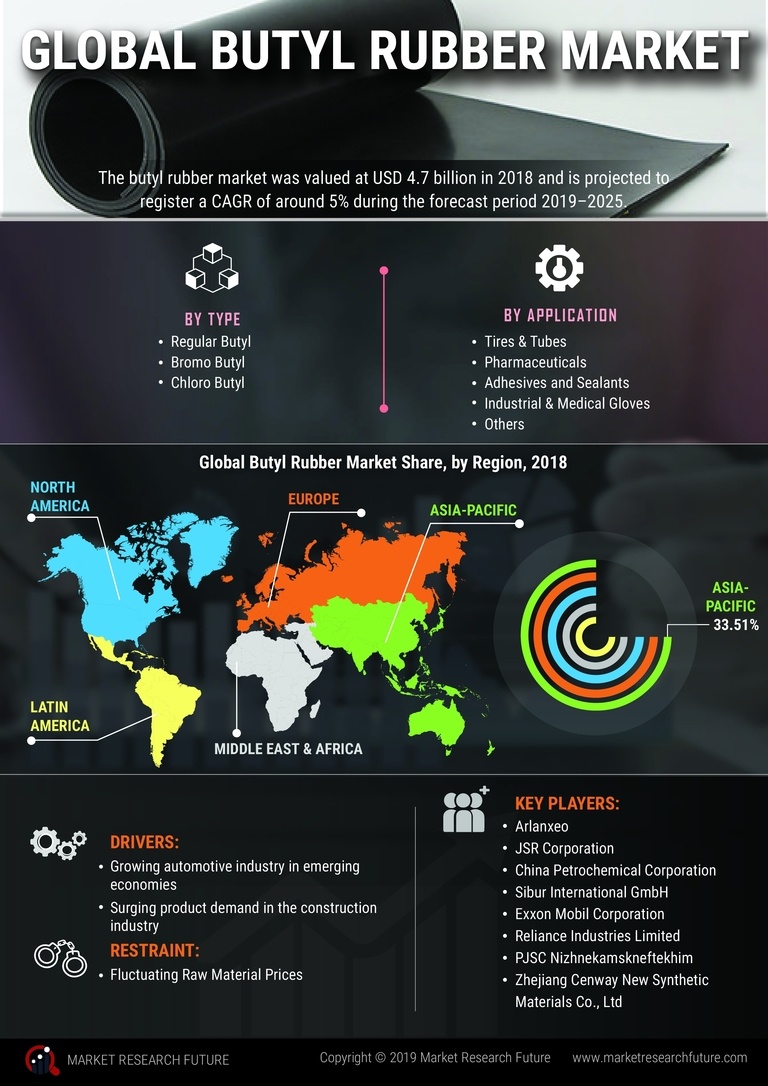

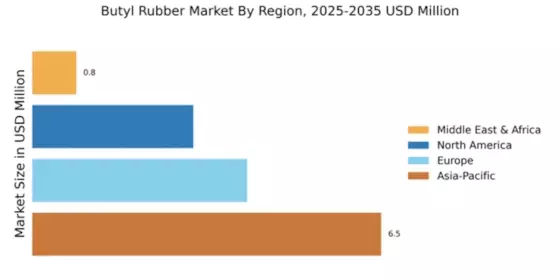

Growing Demand from Automotive Sector

The automotive sector is a primary driver of the Global Butyl Rubber Market Industry, as butyl rubber is extensively utilized in tire manufacturing due to its superior air retention properties. In 2024, the market is projected to reach 3500 USD Million, with the automotive industry accounting for a substantial portion of this demand. As vehicle production increases globally, particularly in emerging markets, the need for high-performance tires is expected to rise. This trend suggests that the automotive sector will continue to fuel growth in the butyl rubber market, potentially leading to a market value of 5200 USD Million by 2035.

Rising Demand for Adhesives and Sealants

The Global Butyl Rubber Market Industry is experiencing a surge in demand for adhesives and sealants, driven by the construction and manufacturing sectors. Butyl rubber's properties, such as flexibility and resistance to moisture, make it a preferred choice for various applications, including roofing and automotive sealing. As construction activities ramp up globally, particularly in developing regions, the demand for high-performance adhesives is expected to increase. This trend may contribute to the overall market growth, with projections indicating a market value of 5200 USD Million by 2035, reflecting the expanding applications of butyl rubber in diverse industries.

Technological Advancements in Production

Technological advancements in the production of butyl rubber are poised to enhance the efficiency and sustainability of the Global Butyl Rubber Market Industry. Innovations in polymerization processes and recycling technologies are likely to reduce production costs and environmental impact. As manufacturers adopt these advanced techniques, the quality and performance of butyl rubber products may improve, thereby attracting new applications and customers. This evolution in production technology could support the market's growth trajectory, aligning with the anticipated CAGR of 3.66% from 2025 to 2035, as companies strive to meet evolving consumer demands.