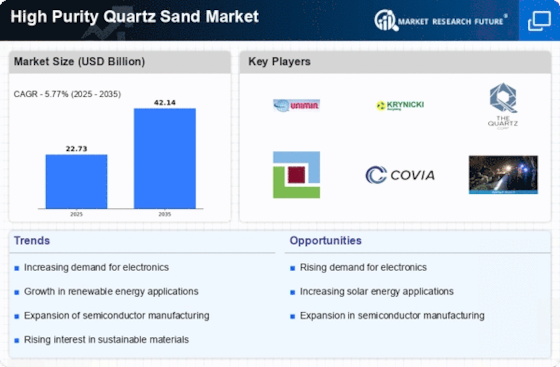

High Purity Quartz Sand Market Summary

As per Market Research Future analysis, the High Purity Quartz Sand Market Size was estimated at 2,131.6 USD Million in 2024. The High Purity Quartz Sand industry is projected to grow from 2,251.2 USD Million in 2025 to 5,918.9 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 10.1% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

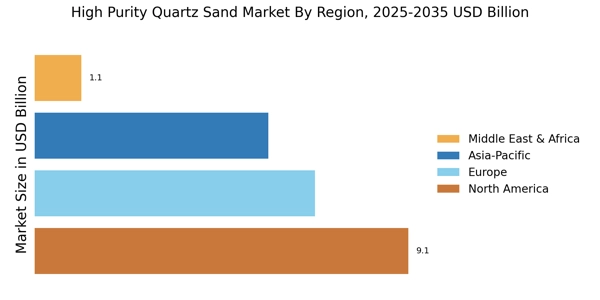

The High Purity Quartz (HPQ) Sand Market is experiencing consistent and strategic growth, driven primarily by expanding demand from high-technology and industrial ecosystems where ultra-clean silica feedstock is mission-critical. The strongest pull is coming from semiconductors, solar photovoltaics, fiber-optic communications, and advanced electronics, supported by the global scaling of 5G/AI computing infrastructure, rapid capacity additions in monocrystalline silicon wafer production, and multi-GW solar manufacturing buildouts across Asia, North America, and Europe.

- The market is witnessing accelerated consumption for crucibles, quartz tubing, chamber components, high-temperature process vessels, wafer fabrication parts, PV ingots, optical lenses, and telecom-grade glass, reinforced by new fabs, polysilicon/wafer expansions, and solar supply-chain localization initiatives. High entry barriers around contamination control, mineral selection, trace impurity removal, and consistency are keeping the industry tightly consolidated around a few critical suppliers.

- Governments and technology manufacturers are tightening purity and traceability expectations, especially for <20 ppm impurity grades used in EUV/advanced lithography, Czochralski crystal growth, solar ingot pulling, and telecom optics, accelerating investments in beneficiation, magnetic separation, acid leaching, and thermal refining technologies to meet next-generation electronic and optical performance standards.

- The rapid expansion of high-efficiency TOPCon, HJT, and tandem solar cell architectures is creating new opportunities for low-alkali, low-metal, and defect-controlled quartz feedstock, enabling better ingot yield, reduced micro-cracks, improved transmission, and longer service life for quartz-based manufacturing consumables.

- Advanced mineral processing automation, digital contamination monitoring, inline ICP impurity scanning, smart acid-leach reactors, precision classification systems, AI-assisted beneficiation control, and closed-loop chemical recovery units are improving production stability, reducing processing chemical losses, increasing batch uniformity, and enhancing operational sustainability for HPQ refiners

- Ongoing advancements in sub-10 ppm refining, defect-suppressed quartz grain engineering, high-temperature shock-resistant quartz formulations, ultra-optical transparency grades, and fully traceable solar-semiconductor quartz supply chains are expected to redefine performance benchmarks, expand usable end-applications, and support long-term market growth in the HPQ industry.

Market Size & Forecast

| 2024 Market Size | 2,131.6 (USD Million) |

| 2035 Market Size | 5,918.9 (USD Million) |

| CAGR (2025 - 2035) | 10.1% |

Major Players

Sibelco, The Quartz Corp, Russian Quartz LLC, Jiangsu Pacific Quartz Co., Ltd, ULTRA HPQ, Standford Advanced Materials, Donghai Shihu Quartz Co.,Ltd, PAL QUARTZ, Unique Crystal Minerals LLP and Quarzwerke GmbH.