Top Industry Leaders in the High Performance Fluoropolymer Market

The High-Performance Fluoropolymer (HPFP) market is experiencing a surge, fueled by their unparalleled properties. These versatile polymers, renowned for their chemical resistance, thermal stability, and low friction, are finding applications in diverse industries, from aerospace and electronics to automotive and medical devices. However, this dynamic landscape demands a strategic approach to secure market share and thrive in the face of fierce competition.

Key Strategies Fueling Market Leaders:

-

Product Diversification: Leading players like DuPont, Chemours, and Daikin are constantly expanding their HPFP portfolios, introducing novel grades and formulations tailored to specific end-use requirements. This differentiation helps them capture niche markets and foster customer loyalty. -

Vertical Integration: Gaining control over critical resources like fluorocarbons is key to ensuring stable supply chains and cost competitiveness. Companies like 3M and Saint-Gobain are actively pursuing vertical integration, securing upstream raw material procurement. -

Technological Advancements: Continuous research and development in manufacturing processes and fluoropolymer science are crucial for maintaining market leadership. Dow Chemical's recent breakthrough in using recycled feedstock for perfluoroalkoxy (PFA) production exemplifies this commitment to innovation. -

Geographic Expansion: Emerging economies like China and India offer vast potential for HPFPs. Companies like Asahi Glass and Dongyue Group are strategically building production facilities in these regions to capitalize on the growing demand. -

Sustainability Focus: Environmental concerns surrounding traditional HPFPs are pushing manufacturers towards eco-friendly alternatives. Sumitomo Chemical's "Fluorinated Ethylene-Propylene" (FEP) with reduced fluorine content and Chemours' efforts in perfluorooctanoic acid (PFOA)-free PTFE production demonstrate this shift towards sustainable practices.

Factors Dictating Market Share:

-

Brand Reputation and Reliability: Established players like Wacker Chemie and Solvay, with their strong brand recognition and proven track records, hold significant market share. However, innovative startups addressing specific niche applications can carve out their space. -

Cost Competitiveness: Optimizing production processes and raw material sourcing are crucial for cost leadership. Asian manufacturers often have an edge due to lower labor costs, but premium brands command higher prices due to superior quality and reliability. -

Distribution Network and Customer Service: Extensive distribution networks and strong customer relationships enable prompt delivery and technical support, fostering customer loyalty and repeat business. Companies like 3M excel in this area. -

Regulatory Landscape: Stringent environmental regulations, especially in Europe and North America, are pushing manufacturers towards sustainable alternatives. Adapting to evolving regulations and developing compliant products becomes crucial for market success.

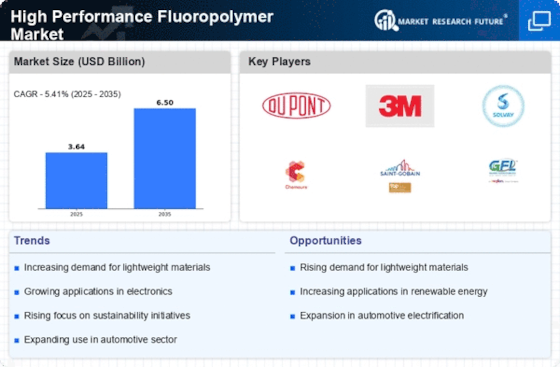

Key Players:

Solvay (Belgium), 3M (U.S.), DuPont (U.S.), Shamrock Technologies (U.S.), The Chemours Company (U.S.), DAIKIN INDUSTRIES, Ltd. (Japan), AGCCE (U.K), Gujarat Fluorochemicals Ltd. (India), Hubei Everflon Polymer CO., Ltd. (China), Shanghai 3F New Materials Co., Ltd.(China) among others.

Industry News and Recent Developments:

August 2023: 3M acquires Dyneon, a leading HPFP manufacturer, strengthening its position in the automotive and aerospace sectors.

October 2023: Chemours unveils a new generation of FEP with improved processing characteristics and sustainability, targeting the wire and cable market.

November 2023: The European Union proposes a ban on some long-chain perfluoroalkyl and polyfluoroalkyl substances (PFAS), raising concerns for HPFP manufacturers but also promoting alternative development.

December 2023: Dongyue Group successfully tests a new process for recycling PTFE waste, potentially creating a more sustainable production model.