Government Regulations and Policies

The Heavy-Duty Electric Vehicle Charging Infrastructure Market is significantly influenced by government regulations and policies aimed at promoting electric vehicle adoption. Many countries have implemented stringent emissions standards and incentives for electric vehicle purchases, which encourage fleet operators to transition to electric heavy-duty vehicles. For instance, various regions have set ambitious targets for reducing greenhouse gas emissions, which necessitates the establishment of comprehensive charging networks. The implementation of these regulations is expected to drive the growth of the Heavy-Duty Electric Vehicle Charging Infrastructure Market, as stakeholders seek to comply with new standards and capitalize on available incentives. This regulatory landscape creates a favorable environment for investment in charging infrastructure, thereby enhancing market potential.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are becoming a driving force in the Heavy-Duty Electric Vehicle Charging Infrastructure Market. Many companies are committing to reducing their carbon footprints and are increasingly investing in electric heavy-duty vehicles as part of their sustainability strategies. This shift is prompting businesses to seek out reliable charging infrastructure to support their electric fleets. As organizations prioritize sustainability, the demand for charging solutions is expected to rise, leading to increased investments in the Heavy-Duty Electric Vehicle Charging Infrastructure Market. This trend not only aligns with corporate social responsibility goals but also enhances operational efficiency, making it a compelling proposition for businesses.

Growth of E-commerce and Logistics Sectors

The expansion of e-commerce and logistics sectors is driving the demand for heavy-duty electric vehicles, thereby impacting the Heavy-Duty Electric Vehicle Charging Infrastructure Market. As online shopping continues to grow, logistics companies are increasingly adopting electric trucks to meet delivery demands while adhering to sustainability goals. This trend is expected to result in a higher demand for charging infrastructure to support electric fleets. Market data indicates that the logistics sector is projected to invest heavily in electric vehicles, which will necessitate the development of extensive charging networks. Consequently, the Heavy-Duty Electric Vehicle Charging Infrastructure Market is poised for growth as it adapts to the evolving needs of these sectors.

Technological Innovations in Charging Solutions

Technological advancements are playing a pivotal role in shaping the Heavy-Duty Electric Vehicle Charging Infrastructure Market. Innovations such as ultra-fast charging technology and smart charging solutions are enhancing the efficiency and convenience of charging heavy-duty electric vehicles. These advancements not only reduce charging times but also optimize energy consumption, making electric vehicles more appealing to fleet operators. The integration of renewable energy sources into charging stations further supports sustainability goals. As technology continues to evolve, the Heavy-Duty Electric Vehicle Charging Infrastructure Market is likely to witness increased investment in research and development, leading to more efficient and user-friendly charging solutions.

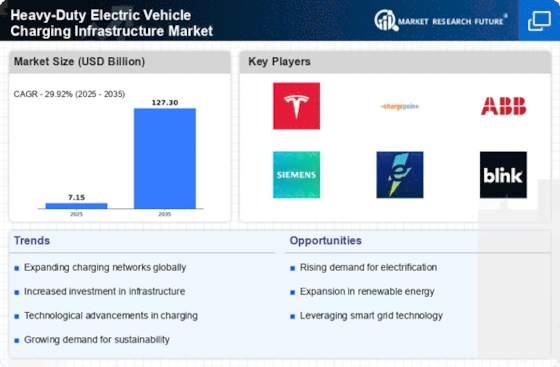

Increasing Demand for Sustainable Transportation

The Heavy-Duty Electric Vehicle Charging Infrastructure Market is experiencing a surge in demand driven by the global shift towards sustainable transportation solutions. As governments and organizations prioritize reducing carbon emissions, the adoption of electric heavy-duty vehicles is becoming more prevalent. This transition is supported by various initiatives aimed at promoting electric mobility, which in turn necessitates the expansion of charging infrastructure. According to recent data, the number of electric heavy-duty vehicles is projected to increase significantly, leading to a corresponding rise in the need for robust charging networks. This growing demand for sustainable transportation options is likely to propel investments in the Heavy-Duty Electric Vehicle Charging Infrastructure Market, fostering innovation and development in charging technologies.