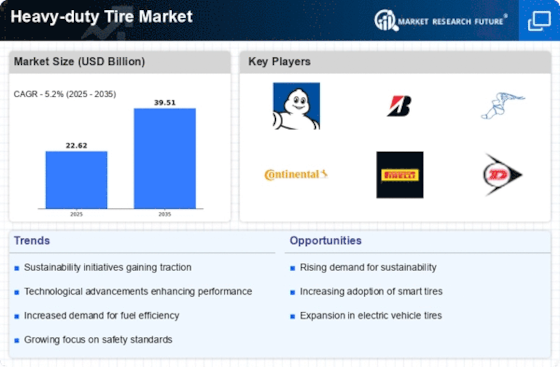

Focus on Fuel Efficiency

The Heavy-duty Tire Market is increasingly focusing on fuel efficiency as a critical driver of growth. With rising fuel costs and environmental concerns, fleet operators are seeking tires that not only enhance vehicle performance but also contribute to lower fuel consumption. In 2025, it is projected that tires designed for fuel efficiency will capture a significant portion of the market, as they can reduce rolling resistance and improve overall vehicle efficiency. This trend is prompting manufacturers to invest in research and development to create innovative tire technologies that align with sustainability goals. As a result, the Heavy-duty Tire Market is likely to see a shift towards eco-friendly tire solutions that appeal to environmentally conscious consumers and businesses.

Infrastructure Development Projects

Infrastructure development projects are significantly influencing the Heavy-duty Tire Market. Governments and private entities are investing heavily in road construction and maintenance, which directly impacts the demand for heavy-duty tires. In 2025, it is anticipated that infrastructure spending will reach unprecedented levels, particularly in emerging markets where urbanization is accelerating. This increase in infrastructure projects necessitates the use of heavy-duty vehicles, which in turn drives the demand for specialized tires designed for construction and heavy transport. The Heavy-duty Tire Market must respond to this trend by providing tires that offer enhanced traction, durability, and load-bearing capacity, ensuring they meet the rigorous demands of construction environments.

Increasing Demand for Commercial Vehicles

The Heavy-duty Tire Market is experiencing a notable surge in demand for commercial vehicles, driven by the expansion of e-commerce and logistics sectors. As businesses increasingly rely on freight transportation, the need for durable and reliable tires becomes paramount. In 2025, the commercial vehicle segment is projected to account for a substantial share of the overall tire market, with estimates suggesting a growth rate of approximately 4.5% annually. This trend indicates that manufacturers must adapt to the evolving requirements of commercial fleets, emphasizing the importance of high-performance tires that can withstand rigorous usage. Consequently, the Heavy-duty Tire Market is likely to witness innovations aimed at enhancing tire longevity and performance, catering to the specific needs of commercial vehicle operators.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, significantly impacting the Heavy-duty Tire Market. Governments worldwide are implementing regulations aimed at improving road safety and reducing environmental impact, which directly influences tire design and manufacturing. In 2025, it is anticipated that compliance with these regulations will drive demand for tires that meet higher safety and performance standards. Manufacturers will need to invest in quality assurance processes and materials that adhere to these evolving regulations. This focus on compliance not only enhances safety for end-users but also positions the Heavy-duty Tire Market to align with global sustainability initiatives, ultimately fostering consumer trust and brand loyalty.

Technological Innovations in Tire Manufacturing

Technological innovations are reshaping the Heavy-duty Tire Market, with advancements in materials and manufacturing processes leading to enhanced tire performance. The integration of smart technologies, such as sensors and data analytics, is becoming increasingly prevalent, allowing for real-time monitoring of tire conditions. This trend is expected to grow, with manufacturers focusing on developing tires that not only provide superior durability but also offer predictive maintenance capabilities. In 2025, the adoption of these technologies is likely to drive a competitive edge for companies that can deliver high-quality, technologically advanced tires. Consequently, the Heavy-duty Tire Market is poised for transformation as it embraces these innovations to meet the demands of modern transportation.