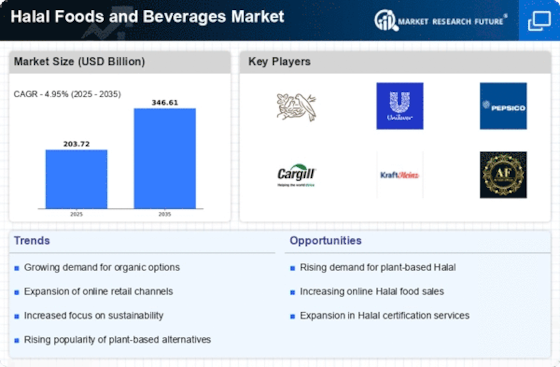

Expansion of Retail Outlets

The expansion of retail outlets dedicated to Halal products is significantly influencing the Halal Foods and Beverages Market. Supermarkets, specialty stores, and online platforms are increasingly offering a diverse range of Halal-certified products, making them more accessible to consumers. This proliferation of retail options is likely to enhance visibility and availability, thereby driving sales. In recent years, the number of Halal-certified establishments has reportedly increased, with many retailers recognizing the lucrative potential of catering to this market segment. As a result, the Halal Foods and Beverages Market is poised for growth, as consumers find it easier to locate and purchase Halal products that meet their dietary needs.

Growing Health Consciousness

Health consciousness among consumers is a pivotal driver for the Halal Foods and Beverages Market. As individuals become increasingly aware of the health implications of their dietary choices, there is a notable shift towards products perceived as healthier. Halal foods, often associated with higher standards of hygiene and quality, are gaining traction among health-conscious consumers. Reports indicate that the organic and natural food segments are witnessing substantial growth, with Halal products often falling within these categories. This trend suggests that the Halal Foods and Beverages Market may experience a surge in demand as consumers prioritize health and wellness, seeking out products that not only meet their dietary restrictions but also contribute positively to their overall well-being.

Increasing Muslim Population

The Halal Foods and Beverages Market is experiencing growth driven by the increasing Muslim population worldwide. As of 2025, it is estimated that Muslims constitute approximately 25% of the global population, which translates to over 1.9 billion individuals. This demographic shift is likely to enhance the demand for Halal-certified products, as adherence to dietary laws is a fundamental aspect of Islamic practice. Furthermore, the rising awareness among non-Muslims about Halal products, often perceived as healthier and ethically sourced, could potentially expand the consumer base. The Halal Foods and Beverages Market, therefore, stands to benefit from this demographic trend, as more consumers seek products that align with their values and dietary requirements.

Cultural Acceptance and Awareness

Cultural acceptance and awareness of Halal products are crucial drivers for the Halal Foods and Beverages Market. As societies become more multicultural, there is a growing recognition and appreciation for diverse dietary practices, including Halal. Educational initiatives and media representation are contributing to a broader understanding of Halal principles, which may lead to increased acceptance among non-Muslim consumers. This cultural shift could potentially expand the market for Halal products beyond traditional consumer bases. The Halal Foods and Beverages Market, therefore, stands to benefit from this enhanced awareness, as more individuals seek to explore and incorporate Halal options into their diets, driven by curiosity and a desire for inclusivity.

Technological Advancements in Food Production

Technological advancements in food production are playing a transformative role in the Halal Foods and Beverages Market. Innovations in food processing, preservation, and packaging are enhancing the quality and shelf life of Halal products. Moreover, advancements in traceability technologies are enabling consumers to verify the Halal status of products more easily, thereby fostering trust and transparency. As consumers increasingly demand assurance regarding the authenticity of Halal claims, these technological improvements could significantly impact purchasing decisions. The Halal Foods and Beverages Market is likely to see a positive response as producers adopt these technologies to meet consumer expectations and enhance product offerings.