Top Industry Leaders in the Halal Foods Beverages Market

Strategies Adopted by Halal Foods & Beverages Key Players

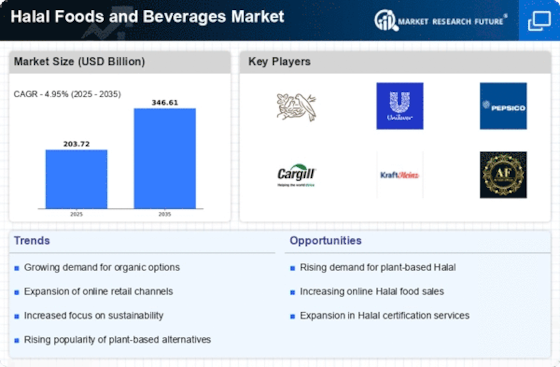

The Halal Foods & Beverages market has witnessed substantial growth driven by the increasing global Muslim population and the growing preference for Halal-certified products among non-Muslim consumers. This analysis provides insights into the competitive landscape, including key players, strategies adopted, market share determinants, news, emerging companies, industry trends, current investment patterns, overall competitive scenarios, and a notable development in 2023.

Key Players:

American Halal Company Inc. (US)

Cleone Foods Ltd. (UK)

Nestle S.A. (Switzerland)

Al Islami Foods (The UAE)

BRF S.A. (Brazil)

QL Foods Sdn. Bhd. (Malaysia)

Nema Food Company (US)

Beijing Shunxin Agriculture Co.

Ltd. (China)

Namet Gıda San. Ve Tic. Inc. (Turkey)

Midamar Corporation (US)

Tahira Foods Ltd (UK)

The Halal Foods & Beverages market employ diverse strategies to strengthen their market positions. Common approaches include strategic partnerships, acquisitions, adherence to strict certification standards, and a focus on research and development to cater to the diverse preferences of Halal consumers. For example, Nestlé has actively pursued partnerships with regional Halal certification bodies to ensure the authenticity and compliance of its Halal product range.

Market Share Analysis:

Market share analysis in the Halal Foods & Beverages market involves evaluating several factors that contribute to competitive advantages. Key considerations include the level of adherence to Halal standards, distribution efficiency, consumer trust, and the ability to provide a wide range of Halal-certified products. Companies that effectively address these factors are better positioned to capture and expand their market share.

Brand recognition and reputation play a crucial role in market share determination, with consumers often choosing products from established and trusted Halal brands. The ability to cater to the diverse dietary needs of Halal consumers, including specific regional preferences, is also a significant factor influencing market share in this competitive segment.

News & Emerging Companies:

The Halal Foods & Beverages market has seen the emergence of new players responding to the increasing demand for Halal products. In 2023, companies like Haloodies entered the market, focusing on providing high-quality Halal meats to consumers. These emerging entities contribute to market diversification, bringing fresh perspectives and solutions to the evolving Halal food and beverage landscape.

Industry news also highlights collaborations between multinational companies and local Halal certification bodies to streamline the certification process and enhance the availability of a wider range of Halal products. These developments reflect the industry's commitment to meeting the expanding demands of the global Halal market.

Industry Trends:

The Halal Foods & Beverages market revolves around innovations in production processes, expansion into new markets, and partnerships with Halal certification bodies to ensure the credibility of Halal claims. Companies are investing in research and development to introduce new Halal product variants and enhance the quality and authenticity of existing products.

Current investment trends underscore the importance of aligning with local Halal certification standards and catering to regional preferences. Investments in marketing and promotion strategies that communicate the Halal integrity of products are also evident, as companies seek to build consumer trust and loyalty in this competitive market.

Competitive Scenario:

The Halal Foods & Beverages market is characterized by a focus on authenticity, adherence to religious standards, and the ability to offer a diverse range of Halal-certified products. Established players with a strong global presence have a competitive edge, while emerging companies contribute to market dynamism by introducing new product offerings and catering to specific consumer needs.

Recent Development

The Halal Foods & Beverages market in 2023 was Cargill's expansion of its Halal protein production facility in the United States. This expansion aimed to meet the growing demand for Halal meat products in the North American market. Cargill's investment demonstrated a strategic commitment to increasing production capacity to serve the Halal segment, aligning with the company's goal to provide diverse, high-quality Halal offerings to consumers globally.