Rising Consumer Demand

The Global Gin Industry experiences a notable surge in consumer demand, driven by the increasing popularity of gin-based cocktails and premium spirits. As of 2024, the market is valued at 9.9 USD Billion, reflecting a growing preference for artisanal and scraft gin product. This trend is particularly evident in urban areas where consumers seek unique flavor profiles and high-quality ingredients. The rise of social media platforms has also contributed to this demand, as consumers share their experiences and recommendations, further fueling interest in gin. This evolving consumer landscape suggests a robust growth trajectory for the industry.

Growth of the Cocktail Culture

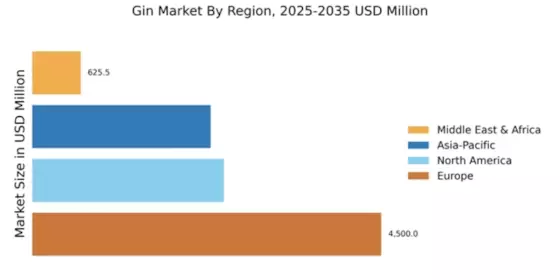

The cocktail culture continues to flourish globally, significantly impacting the Global Gin Industry. Bars and restaurants are increasingly incorporating gin into their cocktail menus, showcasing its versatility and enhancing its status as a premium spirit. This trend is particularly pronounced in metropolitan areas where mixologists craft innovative gin cocktails that attract discerning consumers. The cocktail renaissance has led to a resurgence in gin consumption, contributing to the industry's growth. As the market evolves, it is anticipated that the cocktail culture will further bolster gin sales, supporting the industry's projected CAGR of 4.09% from 2025 to 2035.

Innovative Flavors and Craftsmanship

Innovation in flavors and craftsmanship plays a pivotal role in the Global Gin Industry. Distilleries are increasingly experimenting with botanicals, resulting in a diverse array of gin varieties that cater to evolving consumer tastes. For instance, the introduction of floral, fruity, and spicy gins has attracted a broader audience, enhancing the market's appeal. This trend aligns with the industry's projected growth, as the market is expected to reach 15.4 USD Billion by 2035. The emphasis on quality and creativity in gin production not only differentiates brands but also fosters a deeper connection with consumers, ultimately driving sales.

E-commerce and Digital Marketing Strategies

The Global Gin Industry is witnessing a transformation due to the rise of e-commerce and digital marketing strategies. Online platforms provide consumers with convenient access to a wide range of gin products, facilitating purchases and expanding market reach. Distilleries are leveraging social media and targeted advertising to engage with consumers, fostering brand loyalty and awareness. This shift towards digital channels is particularly relevant in the context of the growing younger demographic, who are more inclined to shop online. As e-commerce continues to evolve, it is expected to play a crucial role in driving sales and enhancing the overall market landscape.

Health Consciousness and Low-Alcohol Options

The rising health consciousness among consumers is influencing the Global Gin Industry, as individuals seek lower-alcohol and healthier beverage options. This shift has prompted distilleries to develop low-alcohol and non-alcoholic gin alternatives, appealing to a demographic that prioritizes wellness without sacrificing flavor. The introduction of these products aligns with the broader trend of mindful drinking, which is gaining traction globally. As consumers increasingly opt for lighter options, the market is likely to see a diversification of product offerings, catering to health-conscious individuals while maintaining the essence of gin.