Growing Health Consciousness

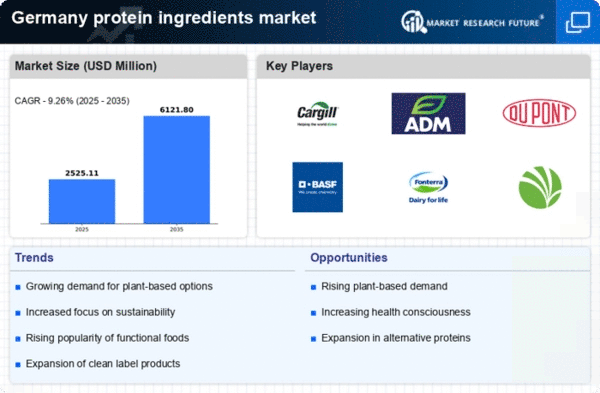

The increasing awareness of health and wellness among consumers in Germany is driving the protein ingredients market. As individuals become more health-conscious, they seek products that offer nutritional benefits, particularly those high in protein. This trend is reflected in the rising demand for protein-enriched foods and beverages, which are perceived as healthier options. According to recent data, the protein ingredients market in Germany is projected to grow at a CAGR of approximately 7% from 2025 to 2030. This growth is indicative of a broader shift towards healthier eating habits, with consumers prioritizing protein intake for muscle maintenance and overall well-being. The protein ingredients market is thus experiencing a significant transformation, as manufacturers adapt their offerings to meet the evolving preferences of health-focused consumers.

Expansion of E-commerce Channels

The rise of e-commerce is significantly impacting the protein ingredients market in Germany. With the increasing preference for online shopping, consumers are seeking convenient access to a wide range of protein products. E-commerce platforms provide an opportunity for manufacturers to reach a broader audience and offer diverse protein ingredient options. The protein ingredients market is witnessing a shift in distribution strategies, with more companies investing in online sales channels to meet consumer demand. Recent statistics indicate that online sales of protein products have surged by over 30% in the past year, reflecting the growing trend of digital shopping. This expansion of e-commerce channels not only enhances consumer accessibility but also encourages competition among manufacturers to innovate and improve their product offerings.

Rising Popularity of Sports Nutrition

The sports nutrition segment is experiencing significant growth within the protein ingredients market in Germany. As fitness and athleticism gain traction among the population, there is a corresponding increase in the demand for protein-rich products designed for athletes and fitness enthusiasts. This trend is supported by a growing awareness of the importance of protein in muscle recovery and performance enhancement. The protein ingredients market is adapting to this demand by offering specialized protein formulations tailored for sports nutrition. Market data suggests that the sports nutrition sector is projected to grow by approximately 8% annually, driven by the increasing participation in sports and fitness activities. This growth presents opportunities for manufacturers to innovate and expand their product lines to cater to the evolving needs of active consumers.

Increased Demand for Sustainable Products

Sustainability has emerged as a crucial factor influencing consumer choices in Germany, particularly in the protein ingredients market. As environmental concerns rise, consumers are increasingly favoring products that are sustainably sourced and produced. This shift is evident in the growing popularity of plant-based protein sources, which are perceived as more environmentally friendly compared to traditional animal-based proteins. The protein ingredients market is responding to this demand by innovating and developing sustainable protein options. Recent studies indicate that the market for plant-based proteins in Germany is expected to reach €1.5 billion by 2026, highlighting the potential for growth in sustainable protein ingredients. This trend not only reflects changing consumer preferences but also encourages manufacturers to adopt more sustainable practices in their production processes.

Technological Advancements in Protein Production

Technological innovations are playing a pivotal role in shaping the protein ingredients market in Germany. Advances in food technology, such as fermentation and extraction methods, are enabling the development of high-quality protein ingredients that cater to diverse consumer needs. These innovations allow for the creation of novel protein sources, enhancing the nutritional profile of food products. The protein ingredients market is witnessing a surge in research and development activities aimed at improving protein extraction techniques and enhancing product functionality. As a result, the market is expected to see a rise in the availability of specialized protein ingredients, which could potentially lead to a market growth rate of around 6% annually over the next five years. This technological progress is crucial for meeting the increasing demand for diverse and functional protein options.