Enhanced Customer Experience

The blockchain in-retail market focuses on enhancing customer experience through innovative solutions. Retailers in Germany are leveraging blockchain to create personalized shopping experiences, which are becoming essential in a competitive landscape. By utilizing blockchain, retailers can securely store customer data and preferences, enabling tailored marketing strategies. This personalization can lead to increased customer satisfaction and loyalty, as consumers are more likely to engage with brands that understand their needs. Additionally, the integration of blockchain can streamline payment processes, reducing transaction times and enhancing convenience. Reports indicate that retailers implementing blockchain solutions have observed a 30% increase in customer retention rates. As the demand for personalized experiences grows, the blockchain in-retail market is expected to expand, driven by the need for improved customer engagement.

Collaboration and Partnerships

The blockchain in-retail market is characterized by collaboration and partnerships among various stakeholders. Retailers, technology providers, and logistics companies in Germany are recognizing the potential of blockchain to enhance supply chain efficiency and transparency. Collaborative initiatives, such as shared blockchain platforms, are emerging to facilitate data sharing and improve operational workflows. These partnerships can lead to innovative solutions that address common challenges faced by the retail sector, such as inventory discrepancies and delivery delays. Furthermore, joint ventures can enable smaller retailers to access advanced blockchain technologies that they might not afford independently. As the market evolves, the trend towards collaboration is likely to strengthen, fostering a more interconnected and efficient blockchain in-retail market.

Increased Demand for Traceability

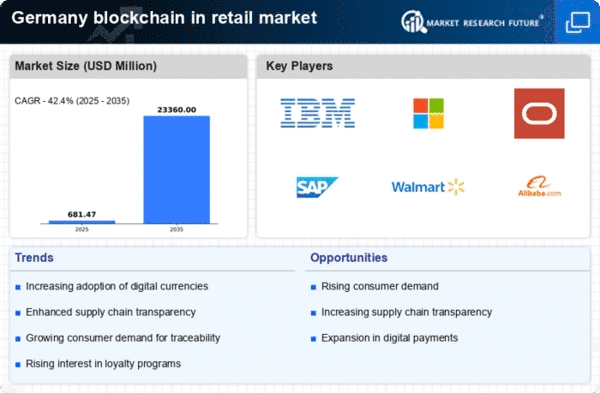

The blockchain in-retail market is experiencing a notable surge in demand for traceability solutions. Consumers in Germany are increasingly concerned about the origins of their products, particularly in sectors such as food and fashion. This heightened awareness has led retailers to adopt blockchain technology to provide transparent supply chain information. According to recent data, approximately 70% of German consumers express a preference for brands that offer clear product provenance. This trend is likely to drive investment in blockchain solutions, as retailers seek to enhance consumer trust and loyalty. Furthermore, the integration of blockchain can potentially reduce fraud and counterfeiting, which are significant issues in the retail sector. As a result, the blockchain in-retail market is poised for growth as businesses strive to meet consumer expectations for transparency.

Cost Reduction and Efficiency Gains

The blockchain in-retail market is shifting towards cost reduction and efficiency gains as retailers optimize their operations. By implementing blockchain technology, businesses can streamline various processes, such as inventory management and payment processing. This technology reduces the need for intermediaries, which can lead to significant cost savings. For instance, studies suggest that retailers could save up to 15% on transaction costs by utilizing blockchain for payment solutions. Moreover, the enhanced transparency and traceability offered by blockchain can minimize losses due to fraud and errors, further contributing to cost efficiency. As retailers in Germany continue to face pressure to improve margins, the adoption of blockchain technology is likely to accelerate, positioning the market for substantial growth in the coming years.

Regulatory Compliance and Standards

The blockchain in-retail market is significantly influenced by the evolving regulatory landscape in Germany. As the government implements stricter regulations regarding data protection and consumer rights, retailers are compelled to adopt technologies that ensure compliance. Blockchain offers a decentralized and secure method for managing sensitive information, which aligns with the General Data Protection Regulation (GDPR) requirements. This compliance is crucial for retailers to avoid hefty fines, which can reach up to €20 million or 4% of annual global turnover, whichever is higher. Consequently, the adoption of blockchain technology is likely to increase as retailers seek to mitigate legal risks and enhance operational efficiency. The proactive approach to regulatory compliance through blockchain could also serve as a competitive advantage in the market, further driving its adoption.