Blockchain in Retail Market Summary

As per Market Research Future analysis, the Blockchain in Retail Market Size was estimated at 11.96 USD Billion in 2024. The Blockchain in Retail industry is projected to grow from 17.04 USD Billion in 2025 to 584.09 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 42.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Blockchain in Retail Market is poised for substantial growth driven by technological advancements and evolving consumer expectations.

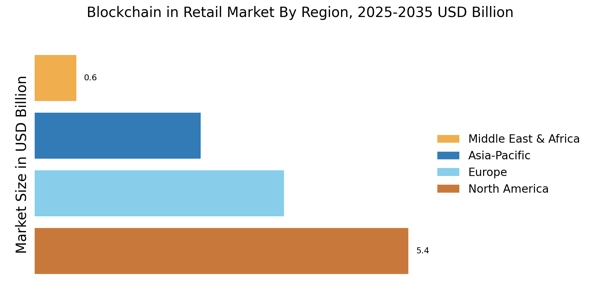

- North America remains the largest market for blockchain in retail, showcasing a robust adoption of innovative technologies.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing investments in blockchain solutions.

- Public blockchain segments dominate the market, while private blockchain solutions are rapidly gaining traction due to their scalability.

- Key market drivers include enhanced traceability of products and improved customer engagement, which are reshaping retail dynamics.

Market Size & Forecast

| 2024 Market Size | 11.96 (USD Billion) |

| 2035 Market Size | 584.09 (USD Billion) |

| CAGR (2025 - 2035) | 42.4% |

Major Players

IBM (US), Microsoft (US), Oracle (US), SAP (DE), Walmart (US), Amazon (US), Alibaba (CN), VeChain (CN), Modum (CH), Ambrosus (CH)