Focus on Cost Efficiency

Cost efficiency remains a critical driver in the virtual private-cloud market, particularly within the GCC region. Businesses are increasingly looking for ways to optimize their IT expenditures while maintaining high performance and security standards. The virtual private-cloud market offers a compelling solution, allowing organizations to pay only for the resources they utilize, thereby minimizing waste. Reports indicate that companies can achieve savings of up to 30% by transitioning to virtual private-cloud environments compared to traditional on-premises solutions. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) in the GCC, which often operate with limited budgets. As a result, the virtual private-cloud market is likely to see continued growth as organizations prioritize cost-effective cloud solutions.

Rising Adoption of Cloud Solutions

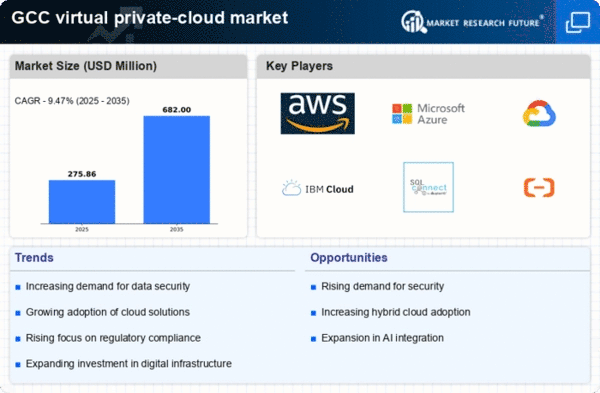

The virtual private-cloud market is experiencing a notable surge in adoption across various sectors in the GCC. Organizations are increasingly recognizing the benefits of cloud solutions, which offer flexibility, scalability, and cost-effectiveness. According to recent data, the cloud computing market in the GCC is projected to grow at a CAGR of approximately 20% from 2025 to 2030. This growth is driven by businesses seeking to enhance operational efficiency and reduce IT costs. As more companies migrate to cloud environments, the demand for virtual private-cloud services is expected to rise, providing tailored solutions that meet specific business needs. The virtual private-cloud market is thus positioned to capitalize on this trend, as organizations prioritize digital transformation and seek reliable cloud infrastructure.

Enhanced Data Management Capabilities

The virtual private-cloud market is increasingly recognized for its enhanced data management capabilities, which are crucial for businesses in the GCC. Organizations are generating vast amounts of data, necessitating efficient storage, processing, and analysis solutions. Virtual private-cloud services provide advanced tools for data management, enabling businesses to leverage analytics and gain insights that drive decision-making. The ability to manage data securely and efficiently is becoming a competitive advantage, particularly in sectors such as finance and healthcare. As the virtual private-cloud market evolves, it is expected to offer even more sophisticated data management solutions, catering to the growing needs of businesses in the region.

Growing Emphasis on Disaster Recovery Solutions

Disaster recovery is a paramount concern for organizations operating in the GCC, and the virtual private-cloud market is well-positioned to address this need. Businesses are increasingly aware of the risks associated with data loss and system failures, prompting them to invest in robust disaster recovery solutions. Virtual private-cloud services offer automated backup and recovery options, ensuring business continuity in the face of unforeseen events. The market for disaster recovery solutions is projected to grow significantly, with estimates suggesting a CAGR of around 15% over the next five years. This trend indicates that the virtual private-cloud market will play a vital role in helping organizations safeguard their critical data and maintain operational resilience.

Increased Collaboration and Remote Work Solutions

The shift towards remote work has fundamentally altered the way organizations operate in the GCC, driving demand for collaborative tools and virtual private-cloud solutions. As businesses adapt to hybrid work models, the need for secure and efficient collaboration platforms has intensified. Virtual private-cloud services facilitate seamless communication and collaboration among remote teams, providing secure access to applications and data from anywhere. This trend is expected to continue, with the virtual private-cloud market likely to expand its offerings to include enhanced collaboration features. As organizations prioritize employee productivity and engagement, the demand for virtual private-cloud solutions that support remote work is anticipated to grow.