Rising Demand for Scalable Solutions

The virtual private-cloud market is experiencing a notable surge in demand for scalable solutions. Organizations are increasingly seeking cloud services that can grow alongside their business needs. This trend is driven by the necessity for flexibility in resource allocation, allowing companies to adjust their cloud capacity based on fluctuating workloads. According to recent data, the market for scalable cloud solutions is projected to expand at a CAGR of approximately 20% over the next five years. This growth indicates a strong preference for virtual private-cloud services that offer dynamic scaling capabilities, enabling businesses to optimize their operational efficiency. As companies continue to embrace digital transformation, the virtual private-cloud market is likely to benefit from this rising demand for scalable solutions.

Cost Efficiency and Budget Management

Cost efficiency remains a critical driver in the virtual private-cloud market. Organizations are increasingly focused on optimizing their IT budgets while ensuring robust performance and security. The ability to pay for only the resources utilized, rather than investing in extensive on-premises infrastructure, is appealing to many businesses. Reports suggest that companies can save up to 30% on IT costs by transitioning to virtual private-cloud solutions. This financial incentive is particularly relevant for small to medium-sized enterprises (SMEs) that may lack the capital for large-scale IT investments. As budget management becomes a priority, the virtual private-cloud market is likely to see continued growth as organizations seek cost-effective alternatives to traditional IT setups.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is a significant driver influencing the virtual private-cloud market. With increasing scrutiny on data privacy and protection, organizations are compelled to adopt cloud solutions that adhere to stringent regulations. The need for data sovereignty, particularly in industries such as finance and healthcare, necessitates that data be stored and processed within specific jurisdictions. This has led to a rise in demand for virtual private-cloud services that can ensure compliance with local laws and regulations. As businesses navigate complex regulatory landscapes, the virtual private-cloud market is expected to expand, providing tailored solutions that meet compliance requirements while maintaining operational efficiency.

Technological Advancements in Cloud Infrastructure

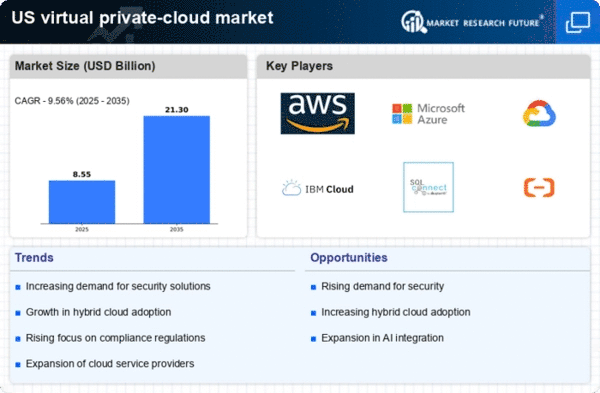

Technological advancements in cloud infrastructure are significantly shaping the virtual private-cloud market. Innovations such as artificial intelligence (AI), machine learning (ML), and automation are enhancing the capabilities of cloud services. These technologies enable organizations to optimize resource management, improve security protocols, and streamline operations. The integration of AI and ML into virtual private-cloud solutions is expected to enhance predictive analytics and operational efficiency. As businesses seek to leverage these advancements, the virtual private-cloud market is poised for growth, driven by the demand for cutting-edge cloud infrastructure that supports advanced technological applications.

Enhanced Collaboration and Remote Work Capabilities

The virtual private-cloud market is benefiting from the growing emphasis on enhanced collaboration and remote work capabilities. As organizations increasingly adopt hybrid work models, the need for secure and efficient collaboration tools has become paramount. Virtual private-cloud solutions facilitate seamless communication and data sharing among remote teams, thereby improving productivity. According to industry estimates, companies utilizing cloud-based collaboration tools report a 25% increase in team efficiency. This trend underscores the importance of virtual private-cloud services in supporting modern work environments. As remote work continues to be a prevalent practice, the virtual private-cloud market is likely to thrive, driven by the demand for collaborative solutions.