Increased Adoption of Cloud Services

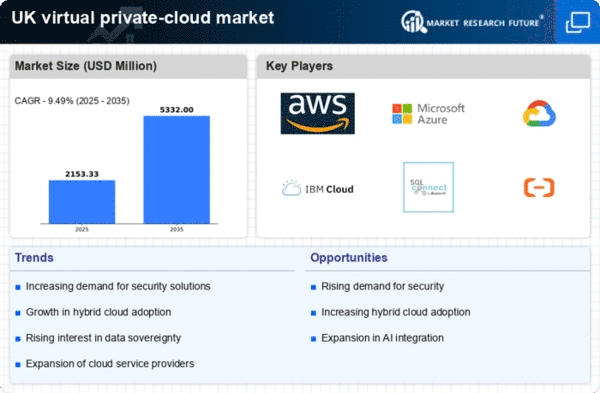

The virtual private-cloud market in the UK is experiencing a notable surge in the adoption of cloud services across various sectors. Businesses are increasingly recognising the benefits of cloud computing, such as scalability, cost-effectiveness, and enhanced collaboration. According to recent data, the UK cloud computing market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for businesses to modernise their IT infrastructure and improve operational efficiency. As organisations migrate to cloud-based solutions, the demand for virtual private-cloud services is likely to rise, providing a secure and flexible environment for data management and application hosting. This trend indicates a shift towards digital transformation, positioning the virtual private-cloud market as a critical component of the broader cloud ecosystem in the UK.

Cost Efficiency and Resource Optimisation

Cost efficiency remains a pivotal driver in the virtual private-cloud market, particularly for small and medium-sized enterprises (SMEs) in the UK. These businesses often face budget constraints and are seeking ways to optimise their IT expenditures. Virtual private-cloud solutions offer a compelling alternative to traditional on-premises infrastructure, allowing organisations to pay only for the resources they use. This pay-as-you-go model can lead to substantial savings, with estimates suggesting that businesses can reduce their IT costs by up to 30% by migrating to a virtual private-cloud environment. Furthermore, the ability to scale resources up or down based on demand enhances operational flexibility, making virtual private-cloud services an attractive option for SMEs looking to maximise their return on investment.

Regulatory Compliance and Data Sovereignty

In the context of the virtual private-cloud market, regulatory compliance is becoming increasingly crucial for UK businesses. With stringent data protection regulations, such as the General Data Protection Regulation (GDPR), organisations are compelled to ensure that their data handling practices align with legal requirements. This has led to a heightened demand for virtual private-cloud solutions that offer robust security features and data sovereignty. Companies are seeking providers that can guarantee data residency within the UK, thereby mitigating risks associated with cross-border data transfers. As a result, the virtual private-cloud market is likely to see growth as businesses prioritise compliance and data security, which are essential for maintaining customer trust and avoiding potential fines.

Growing Focus on Disaster Recovery Solutions

The virtual private-cloud market is witnessing an increasing emphasis on disaster recovery solutions as businesses recognise the importance of data resilience. In the UK, organisations are increasingly investing in backup and recovery strategies to safeguard their critical data against potential disruptions. Virtual private-cloud services provide an effective platform for implementing robust disaster recovery plans, enabling businesses to quickly restore operations in the event of a data loss incident. This trend is underscored by research indicating that nearly 60% of UK businesses have experienced a data breach or loss in the past year. Consequently, the demand for virtual private-cloud solutions that offer comprehensive disaster recovery capabilities is likely to grow, as organisations seek to mitigate risks and ensure business continuity.

Enhanced Collaboration and Remote Work Capabilities

The virtual private-cloud market is being propelled by the increasing need for enhanced collaboration tools and remote work capabilities. As more UK businesses adopt flexible working arrangements, the demand for virtual private-cloud solutions that facilitate seamless collaboration among distributed teams is on the rise. These solutions enable employees to access applications and data from anywhere, fostering productivity and teamwork. Recent studies suggest that organisations leveraging cloud-based collaboration tools can improve employee efficiency by up to 25%. This shift towards remote work is likely to continue influencing the virtual private-cloud market, as businesses seek to implement solutions that support their evolving workforce dynamics and enhance overall operational effectiveness.