Expansion of Distribution Channels

The expansion of distribution channels plays a crucial role in the growth of the dry mouth-relief market. With the rise of e-commerce and online pharmacies, consumers in the GCC region have greater access to a variety of products. This shift allows for a wider selection of dry mouth-relief solutions, including sprays, lozenges, and gels, which can be conveniently purchased from home. Additionally, traditional retail outlets are increasingly stocking these products, making them more accessible to consumers. The convenience of purchasing options is likely to drive sales, as consumers are more inclined to seek relief for their symptoms when products are readily available. The dry mouth-relief market is thus experiencing a transformation in how products reach consumers, enhancing overall market growth.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare is influencing the dry mouth-relief market positively. As individuals become more health-conscious, there is a shift towards proactive management of oral health. This trend is particularly evident in the GCC region, where public health campaigns are promoting awareness of oral hygiene and its connection to overall health. Preventive measures, including the use of dry mouth-relief products, are being integrated into daily routines. This proactive approach is likely to increase the demand for products that alleviate dry mouth symptoms, as consumers seek to maintain optimal oral health. The dry mouth-relief market stands to gain from this trend, as more individuals recognize the importance of addressing dry mouth as part of their preventive healthcare strategies.

Rising Demand for Innovative Formulations

The dry mouth-relief market is witnessing a rising demand for innovative formulations that cater to diverse consumer preferences. As consumers become more discerning, they seek products that not only provide relief but also offer additional benefits, such as flavor enhancement and long-lasting effects. Manufacturers in the GCC region are responding to this demand by developing new formulations that incorporate natural ingredients and advanced technologies. This innovation is likely to attract a broader consumer base, including those who may have previously been hesitant to use dry mouth-relief products. The dry mouth-relief market is thus evolving, with companies investing in research and development to create products that meet the changing needs of consumers.

Growing Prevalence of Dry Mouth Conditions

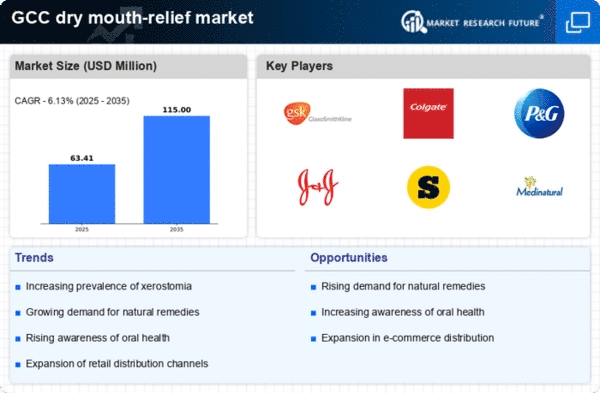

The increasing prevalence of dry mouth conditions, also known as xerostomia, is a notable driver for the dry mouth-relief market. Factors such as aging populations and the rising incidence of chronic diseases contribute to this trend. In the GCC region, it is estimated that around 30% of adults experience some form of dry mouth, which can be exacerbated by medications and lifestyle choices. This growing awareness of the condition has led to a heightened demand for effective relief products. As healthcare providers recognize the impact of dry mouth on quality of life, they are more likely to recommend solutions, thereby expanding the market. The dry mouth-relief market is thus positioned to benefit from this increasing prevalence, as consumers seek remedies to alleviate their symptoms.

Growing Awareness of the Impact of Medications

There is a growing awareness of the impact of medications on oral health, particularly concerning dry mouth. Many individuals in the GCC region are becoming increasingly informed about the side effects of common medications, such as antihistamines and antidepressants, which can lead to xerostomia. This awareness is prompting consumers to seek out dry mouth-relief products as a necessary adjunct to their medication regimens. Healthcare professionals are also more likely to discuss the importance of managing dry mouth with their patients, further driving demand for effective solutions. The dry mouth-relief market is thus benefiting from this heightened awareness, as consumers actively seek products to mitigate the discomfort associated with medication-induced dry mouth.