Growing Demand for Natural Ingredients

There is a noticeable shift towards natural and organic products within the dry mouth-relief market. Consumers are becoming more health-conscious and are increasingly wary of synthetic ingredients. This trend is reflected in the rising sales of products that utilize natural components, such as aloe vera and xylitol, which are perceived as safer alternatives. Market data indicates that products featuring natural ingredients have seen a growth rate of approximately 15% annually. This demand for natural solutions is likely to influence product development strategies, as manufacturers aim to cater to the preferences of health-conscious consumers.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in the US is influencing consumer behavior in the dry mouth-relief market. Individuals are increasingly proactive about their health, seeking solutions that not only address symptoms but also prevent further complications. This trend is reflected in the rising sales of products that promote oral hydration and overall oral health. Market data indicates that preventive products are gaining traction, with a growth rate of around 12% annually. As consumers prioritize long-term health benefits, the demand for preventive dry mouth-relief solutions is expected to rise, shaping the future landscape of the market.

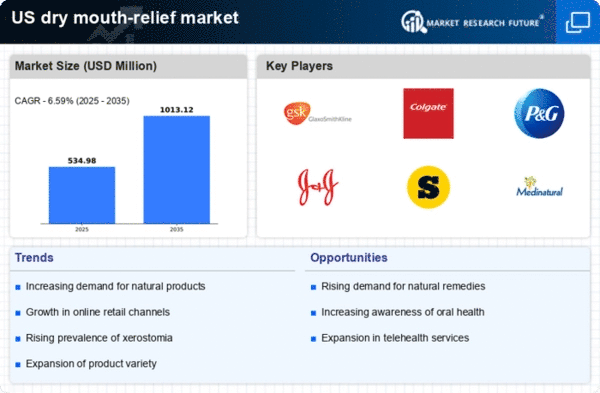

Increased Incidence of Dry Mouth Conditions

The prevalence of dry mouth conditions, also known as xerostomia, appears to be on the rise in the US. Factors such as medication side effects, particularly from antihistamines and antidepressants, contribute significantly to this trend. It is estimated that approximately 30% of adults experience some form of dry mouth, which directly impacts the dry mouth-relief market. As awareness of these conditions grows, consumers are increasingly seeking effective solutions, thereby driving demand for products designed to alleviate symptoms. This trend suggests a potential for market expansion, as more individuals recognize the importance of addressing dry mouth for overall oral health.

Technological Advancements in Product Development

The dry mouth-relief market is experiencing a wave of innovation driven by technological advancements. New formulations and delivery systems, such as sprays and lozenges, are being developed to enhance the effectiveness of dry mouth products. For instance, the introduction of moisture-retaining technologies has shown promise in providing longer-lasting relief. Market analysts suggest that these innovations could lead to a projected growth rate of 10% in the coming years. As companies invest in research and development, the availability of more effective and user-friendly products is likely to attract a broader consumer base.

Rising Awareness of the Impact of Dry Mouth on Quality of Life

There is a growing recognition of how dry mouth can adversely affect quality of life, influencing the dry mouth-relief market. Individuals suffering from this condition often report difficulties in speaking, eating, and swallowing, which can lead to social and psychological challenges. Awareness campaigns and educational initiatives are helping to highlight these issues, prompting more people to seek relief. As a result, the market is likely to see an increase in demand for products that not only alleviate symptoms but also improve overall well-being. This heightened awareness could potentially drive market growth by encouraging more individuals to address their dry mouth concerns.