Growing Elderly Population

The increasing elderly population in the UK is a significant driver for the dry mouth-relief market. As individuals age, they often experience a higher incidence of dry mouth due to various factors, including medication side effects and age-related health conditions. It is estimated that around 30% of older adults suffer from dry mouth, which can lead to complications such as dental issues and difficulty swallowing. This demographic shift suggests a growing demand for effective dry mouth-relief products tailored to the needs of older consumers. Consequently, manufacturers are likely to focus on developing specialized formulations that cater to this segment, thereby expanding their market presence and enhancing product offerings in the dry mouth-relief market.

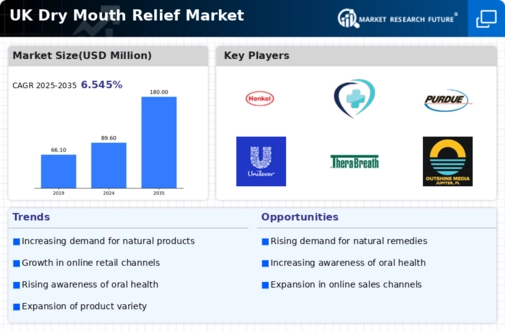

Expansion of Retail Channels

The expansion of retail channels in the UK is poised to influence the dry mouth-relief market positively. With the rise of e-commerce and the increasing presence of health-focused retailers, consumers have greater access to a variety of dry mouth-relief products. This accessibility may encourage more individuals to seek solutions for their dry mouth issues. Additionally, brick-and-mortar stores are likely to enhance their product offerings, providing consumers with a wider selection of options. As a result, the competitive landscape of the dry mouth-relief market may evolve, with companies needing to adapt their distribution strategies to meet changing consumer preferences and shopping habits.

Increased Focus on Oral Hygiene

There appears to be a growing emphasis on oral hygiene and health awareness among the UK population, which is likely to drive the dry mouth-relief market. Consumers are becoming more informed about the implications of dry mouth, including its impact on overall health and well-being. This heightened awareness may lead to increased demand for products that alleviate dry mouth symptoms. Market data suggests that sales of oral care products have risen by approximately 15% in recent years, indicating a shift towards preventive care. As consumers seek effective solutions, manufacturers may invest in marketing campaigns that highlight the benefits of their dry mouth-relief products, thus fostering growth in the market.

Innovations in Product Formulation

Innovations in product formulation are expected to play a crucial role in shaping the dry mouth-relief market. As consumer preferences shift towards more effective and convenient solutions, manufacturers are likely to invest in research and development to create advanced formulations. This could include the incorporation of natural ingredients, improved delivery systems, and enhanced flavor profiles. The market may witness a surge in products that not only provide relief but also promote overall oral health. Such innovations could attract a broader consumer base, including those who may not have previously considered dry mouth-relief products, thereby expanding the market's reach and potential.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in the UK, such as diabetes and autoimmune disorders, is likely to contribute to the growth of the dry mouth-relief market. These conditions often lead to xerostomia as a side effect of medications or the diseases themselves. For instance, studies indicate that approximately 20% of individuals with diabetes report experiencing dry mouth. This correlation suggests that as the population grapples with these health challenges, the demand for dry mouth-relief products will increase. Companies may respond by innovating and marketing products that specifically address the needs of patients with chronic illnesses, thereby enhancing their competitive edge in the dry mouth-relief market.