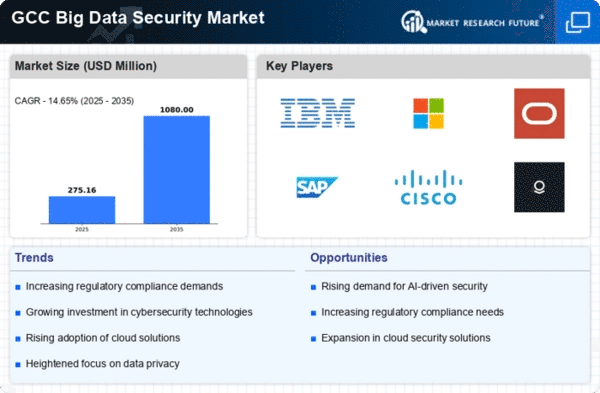

GCC Big Data Security Market Segment Insights

Big Data Security Market Deployment Model Insights

The GCC Big Data Security Market, focusing specifically on the Deployment Model segment, showcases significant diversity with its key categories, including Cloud-Based, On-Premises, and Hybrid deployments.In recent years, the shift towards digital transformation in the GCC, driven by supportive governmental initiatives and investments, has bolstered the demand for advanced big data security solutions. Cloud-Based deployment is gaining traction due to its scalability and flexibility, catering to organizations seeking to manage vast data volumes without substantial upfront infrastructure costs.

This model supports remote accessibility, aligning with current trends of remote working and the need for agile operational frameworks. On-Premises deployment remains a preferred choice for enterprises that prioritize data control and compliance, particularly within sensitive industry sectors such as finance and healthcare where regulatory compliance is crucial.

This model offers enhanced security features, providing businesses with greater governance over their data security protocols. Meanwhile, the Hybrid deployment model emerges as a strong alternative for companies aiming to leverage the benefits of both cloud and on-premises setups.

It allows businesses to store sensitive data on-site while utilizing cloud resources for less critical information, optimizing performance and security. As the GCC region continues to prioritize cybersecurity amid growing concerns over data breaches and regulatory compliance, investments in these deployment models are expected to increase.

Growing awareness about the importance of data protection and evolving threats are driving organizations to adopt more robust security solutions tailored to their unique operational needs.Thus, the deployment model segment plays a pivotal role in the broader GCC Big Data Security Market, offering varied options for organizations to establish a secure data environment while addressing specific market challenges.

With significant advancements in technology and a focus on innovation driven by the increasing digital landscape, the prospects for all deployment models look promising in the region's evolving market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Big Data Security Market Application Insights

The Application segment of the GCC Big Data Security Market comprises essential areas that bolster data confidentiality and integrity. Data Encryption is critical as it ensures that sensitive information remains protected in transit and at rest, a necessity in the region's increasingly digital economy.

Identity and Access Management plays a vital role in safeguarding user credentials and controlling access to systems, thus preventing unauthorized breaches. Data Loss Prevention is significant in an era where data breaches can severely impact enterprises, emphasizing the importance of implementing robust measures to monitor and protect sensitive data.Moreover, Database Security is crucial for the management of critical business information, helping organizations in the GCC to comply with regulatory frameworks and mitigate risks of data compromise.

As companies in the GCC region expand their digital footprint, the demand for these application areas within the Big Data Security Market continues to grow, driven by the necessity for secure digital environments amidst advancing cyber threats and increasing data privacy regulations.

Big Data Security Market End User Insights

The End User segment of the GCC Big Data Security Market is a critical component that exhibits diverse applications across various industries, reflecting the growing demand for data protection solutions. The Banking, Financial Services and Insurance (BFSI) sector plays a vital role in this market, necessitating robust security measures due to the sensitive nature of financial data and regulatory requirements.

Similarly, the IT and Telecommunications industry is increasingly focusing on cybersecurity solutions to safeguard network infrastructures and user data, driven by the rise of digital communication technologies.Healthcare also stands out as a significant user of big data security, as the protection of patient information and compliance with health regulations are paramount. Additionally, the retail sector is rapidly adopting big data security solutions to protect consumer data and improve customer trust in a highly competitive market.

As the GCC region witnesses a surge in digital transformation initiatives, the growing reliance on big data across these sectors underscores the need for effective security strategies to mitigate risks related to data breaches and cyber threats.Understanding the GCC Big Data Security Market segmentation and industry dynamics will be essential as companies adapt to technological advancements and seek to fortify their data protection measures effectively.

Big Data Security Market Security Type Insights

The Security Type segment of the GCC Big Data Security Market exhibits considerable diversity, with key focuses on Network Security, Application Security, Endpoint Security, and Database Security. With the rise in cyber threats across the GCC region, Network Security has become crucial for protecting data integrity and ensuring secure communication channels.

Application Security is gaining attention due to the increasing use of mobile and web applications, which are prime targets for cyber attacks. Meanwhile, Endpoint Security plays an essential role as remote work and the use of personal devices at work rise, necessitating stronger protections for endpoints connected to corporate networks.

Additionally, Database Security is critical in safeguarding sensitive information against unauthorized access and breaches, especially with growing regulatory pressures in the GCC. Each of these areas contributes uniquely to the overall resilience of data security in the region, responding to the evolving cyber threat landscape and emphasizing the need for comprehensive protection strategies.As organizations in the GCC invest in advanced security measures, the segmentation highlights essential focus areas for enhancing overall data security systems.