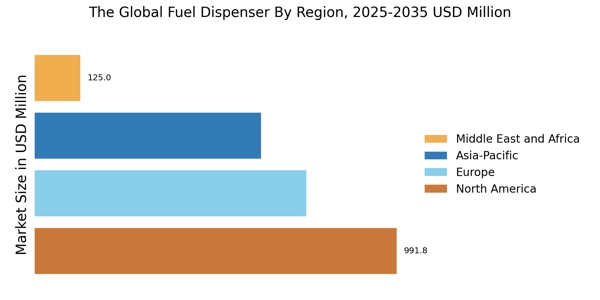

By region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The Asia-Pacific fuel dispenser market accounted for USD xx billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. The government of China, India, and other developing economies are focused on reducing the harmful effects of vehicle emissions on the environment and increasing the price of gasoline, which will help to increase the demand for natural gas vehicles.

By 2025, Volkswagen aims to sell 1 million CNG vehicles and expand the number of CNG filling stations from 900 to 2,000 in Europe, for example. Volkswagen has committed to fueling CNG vehicles with CNG by 2025.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: FUEL DISPENSER MARKET SHARE BY REGION 2021 (%)

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

North America's fuel dispenser market accounts for the second-largest market share. The market growth is attributed to the increase in new vehicle sales, forecasted to reach 16.7 million to 17.1 million vehicles in the United States by 2025, with the growth of CNG stations contributing as well. The CNG dispenser station near the Port of Savannah in Georgia will be constructed and maintained by 2021 under a joint venture agreement between Chesapeake Utilities Corporation and Atlanta Gas Light (AGL).

Further, the U.S. fuel dispenser market held the largest market share, and the Canadian fuel dispenser market was the fastest-growing market in the North American region

The Europe fuel dispenser market is expected to grow at the fastest CAGR from 2022 to 2030. Natural gas is considered the cleanest fuel in Europe, so many vehicles use it. There are 868 CNG stations in Germany, Italy, the Netherlands, Russia, and Ukraine, with 176, 235, and 207 CNG stations, respectively. By 2030, the European Union plans to reduce carbon emissions by 30% using Automotive Natural Gas Vehicle. Therefore, USD 179.17 million is being invested in developing CNG stations.

Moreover, the German fuel dispenser market held the largest market share, and the UK fuel dispenser market was the fastest-growing market in the Asia-Pacific region