Automotive Natural Gas Vehicle Market Summary

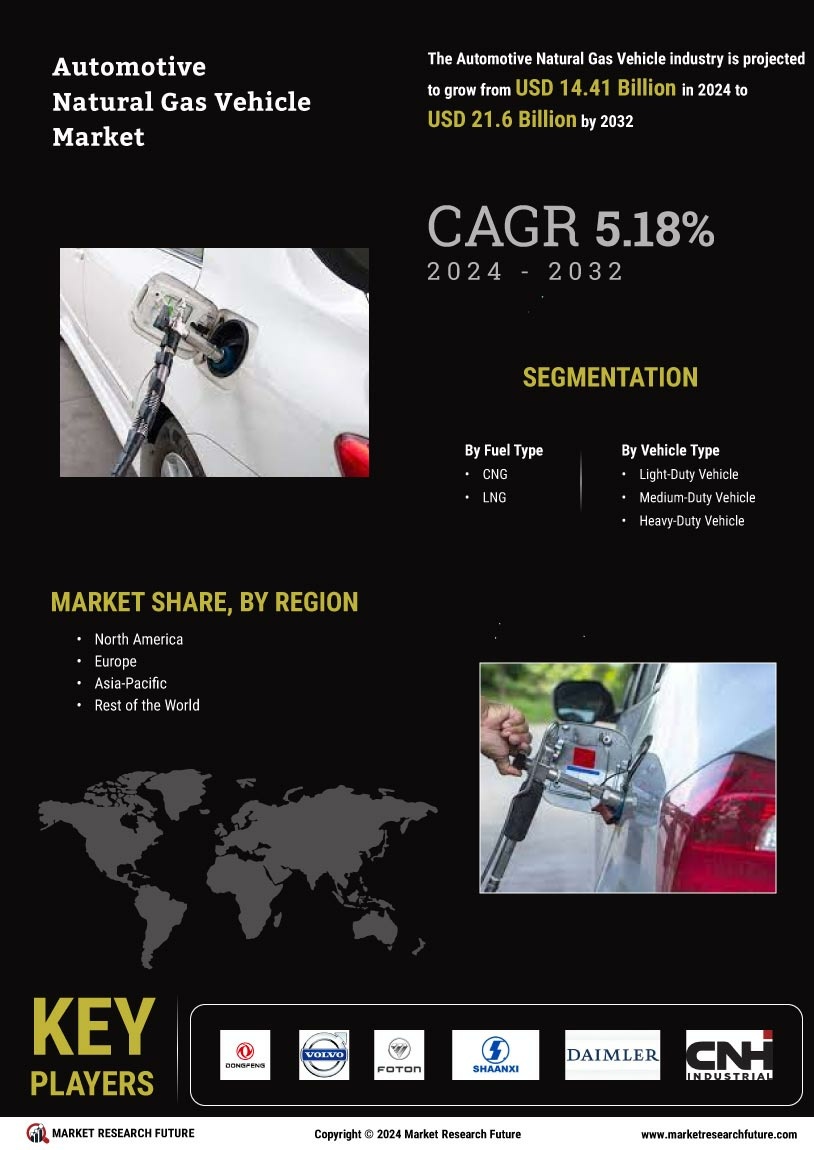

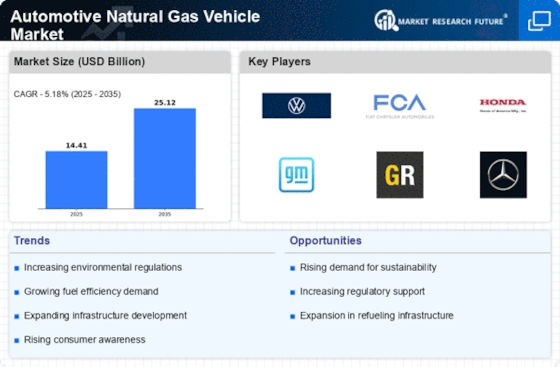

As per Market Research Future Analysis, the Automotive Natural Gas Vehicle Market was valued at USD 14.41 Billion in 2024 and is projected to grow from USD 14.41 Billion in 2024 to USD 25.12 Billion by 2035, with a CAGR of 5.18% during the forecast period. The demand for liquefied Natural Gas (LNG) trucks is increasing due to the need for alternative fuel sources in transportation. Government initiatives to enhance natural gas distribution infrastructure are expected to further boost the market. The CNG segment dominated with over 95% volume share in 2022, while LNG is anticipated to grow the fastest due to favorable policies and economic growth in logistics. The Asia-Pacific region held the largest market share at over 46% in 2022, driven by rising passenger vehicle production, particularly in China.

Key Market Trends & Highlights

Key trends influencing the Automotive Natural Gas Vehicle Market include volatile fuel prices and government regulations.

- Market Size in 2024: USD 14.41 Billion; projected to reach USD 25.12 Billion by 2035.

- CNG segment accounted for over 95% of volume share in 2022; expected to grow steadily.

- Asia-Pacific region held over 46% market share in 2022; driven by passenger vehicle production.

- LNG market anticipated to grow fastest from 2024 to 2032 due to favorable government policies.

Market Size & Forecast

| 2024 Market Size | USD 14.41 Billion |

| 2035 Market Size | USD 25.12 Billion |

Major Players

Dongfeng Motors Group Limited (China), AB Volvo (Sweden), Beiqi Foton Motors Group Limited (China), Shaanxi Automobile Group Limited (China), Daimler AG (Germany), CNH Industrial NV (The Netherlands), Landi Renzo (Italy), Westport (Canada)