Growing Geriatric Population

The aging population in the US is a critical driver for the automatic pill-dispenser market. As individuals age, they often face multiple health issues that require complex medication regimens. The US Census Bureau projects that by 2030, all baby boomers will be older than 65, leading to a significant increase in the number of older adults. This demographic shift creates a heightened need for solutions that assist with medication management. Automatic pill dispensers can help mitigate the challenges faced by elderly patients, such as memory loss and difficulty in managing multiple prescriptions. By providing a user-friendly interface and automated reminders, these devices can enhance adherence and improve health outcomes for the geriatric population. Consequently, the market is poised for growth as the demand for such solutions escalates.

Support from Healthcare Policies

Supportive healthcare policies in the US are fostering growth in the automatic pill-dispenser market. Recent initiatives aimed at improving medication management and patient safety have led to increased funding and resources for innovative healthcare solutions. Policies that promote the use of technology in healthcare, such as the Medicare Access and CHIP Reauthorization Act, encourage the adoption of tools that enhance medication adherence. Additionally, reimbursement models that recognize the value of medication management technologies are emerging, further incentivizing healthcare providers to implement automatic pill dispensers. This supportive regulatory environment is likely to stimulate market growth, as stakeholders seek to align with policy objectives that prioritize patient care and safety. As these policies continue to evolve, the automatic pill-dispenser market may experience significant expansion.

Rising Chronic Disease Prevalence

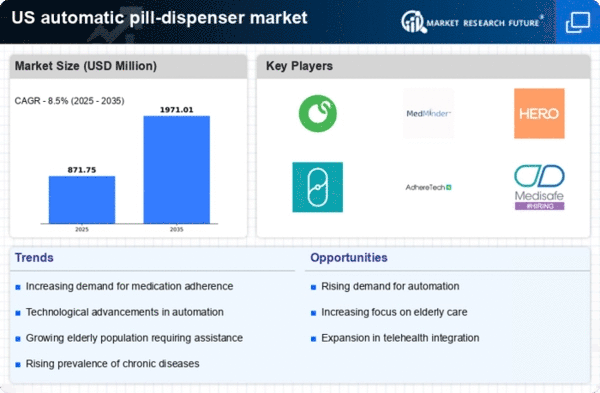

The increasing prevalence of chronic diseases in the US is a notable driver for the automatic pill-dispenser market. Conditions such as diabetes, hypertension, and cardiovascular diseases necessitate regular medication adherence. According to the Centers for Disease Control and Prevention (CDC), approximately 60% of adults in the US have at least one chronic condition, which underscores the need for effective medication management solutions. Automatic pill dispensers can significantly enhance adherence by organizing medications and providing reminders, thereby reducing the risk of complications associated with missed doses. This trend indicates a growing market potential, as healthcare providers and patients alike seek innovative solutions to manage complex medication regimens. As the population ages and the burden of chronic diseases increases, the demand for automatic pill dispensers is likely to expand, positioning this market for substantial growth in the coming years.

Increased Focus on Medication Adherence

The automatic pill-dispenser market is experiencing growth due to an increased focus on medication adherence among healthcare providers and patients. Non-adherence to prescribed medication regimens is a significant issue, leading to adverse health outcomes and increased healthcare costs. Studies suggest that nearly 30% of prescriptions are never filled, and among those that are filled, about 50% are not taken as directed. Automatic pill dispensers address this challenge by simplifying the medication-taking process, thereby improving adherence rates. As healthcare systems in the US emphasize value-based care and patient outcomes, the adoption of technologies that enhance adherence is becoming a priority. This shift is likely to drive demand for automatic pill dispensers, as they offer a practical solution to a pervasive problem in healthcare.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a significant driver for the automatic pill-dispenser market. Innovations such as telehealth, mobile health applications, and electronic health records are transforming how patients manage their medications. Automatic pill dispensers are increasingly being designed to integrate with these technologies, allowing for real-time monitoring and communication between patients and healthcare providers. This integration can enhance patient engagement and facilitate timely interventions when adherence issues arise. As the US healthcare landscape continues to evolve towards more connected and patient-centered care, the demand for automatic pill dispensers that leverage these technologies is expected to rise. This trend indicates a promising future for the market, as stakeholders seek to improve health outcomes through innovative solutions.