Freight and Logistics Market Summary

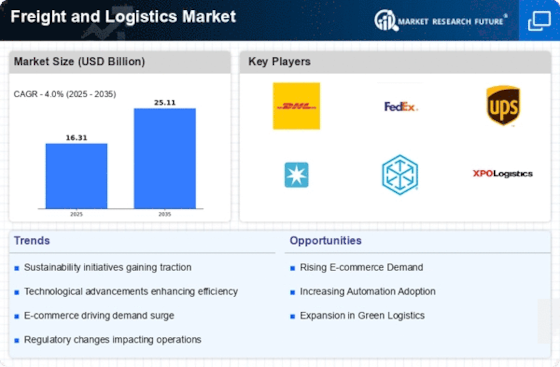

As per Market Research Future analysis, the Freight and Logistics Market was estimated at 16.31 USD Billion in 2024. The Freight and Logistics industry is projected to grow from 16.96 USD Billion in 2025 to 25.11 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Freight and Logistics Market is currently experiencing a transformative phase driven by digital advancements and evolving consumer demands.

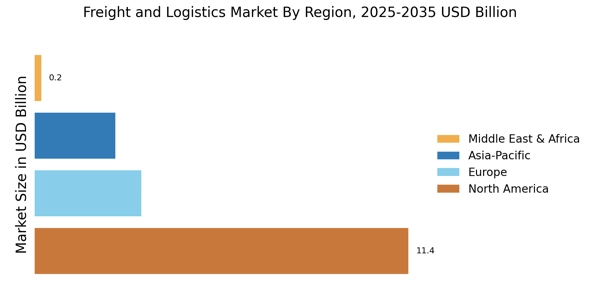

- Digital transformation is reshaping operational efficiencies across the Freight and Logistics Market, particularly in North America.

- Sustainability initiatives are gaining traction, influencing logistics strategies in both North America and Asia-Pacific.

- E-commerce growth continues to propel demand for air freight services, which remains the largest segment in the market.

- Technological advancements and rising consumer expectations are key drivers, particularly impacting the warehousing segment, which is the fastest-growing.

Market Size & Forecast

| 2024 Market Size | 16.31 (USD Billion) |

| 2035 Market Size | 25.11 (USD Billion) |

| CAGR (2025 - 2035) | 4.0% |

Major Players

DHL (DE), FedEx (US), UPS (US), Maersk (DK), C.H. Robinson (US), XPO Logistics (US), Kuehne + Nagel (CH), DB Schenker (DE), Nippon Express (JP)