Top Industry Leaders in the Freight and Logistics Market

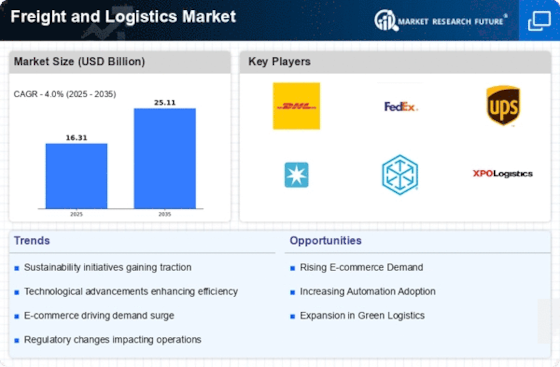

Freight and Logistics Market

The freight and logistics industry, a behemoth underpinning global trade, undergoes constant transformation. Understanding the competitive landscape is crucial for businesses to thrive in this dynamic environment. Let's delve into the key players, strategies, market dynamics, and recent developments shaping this intricate market.

Strategies for Survival and Growth:

-

Specialization: Players are focusing on niche segments like cold chain logistics, e-commerce fulfillment, or oversized cargo transportation to cater to specific customer needs and gain a competitive edge. -

Network Expansion: Mergers and acquisitions are prevalent, as companies strive to expand geographical reach and service offerings. For example, DSV's acquisition of Agility's Global Integrated Logistics business in 2022 solidified its position in emerging markets. -

Technological Innovation: Embracing automation, blockchain, and artificial intelligence for tasks like route optimization, real-time tracking, and demand forecasting is crucial for efficiency and cost reduction. -

Sustainability Initiatives: Companies are adopting greener practices like electric vehicles, biofuels, and carbon offsetting to meet environmental regulations and attract sustainability-conscious clients.

Market Share Determinants:

-

Pricing and Service Quality: Striking a balance between competitive pricing and exceptional service remains critical for attracting and retaining customers. -

Network Connectivity: Extensive global networks and partnerships with transportation providers enable seamless cargo movement and wider market reach. -

Digital Capabilities: Embracing digital tools and automation enhances operational efficiency, transparency, and customer experience, leading to a competitive advantage. -

Financial Strength: Stable finances and access to capital are crucial for investments in infrastructure, technology, and expansion, ensuring long-term viability.

Key Players

- Dsv Global Transports and Logistics (Denmark)

- Kuehne+ Nagel (Switzerland)

- The Maersk Group (Germany)

- Deutsche Post DHL (Germany)

- DB Schenker Logistics (Germany)

- C.H. Robinson (US)

- Panalpina (Switzerland)

- United Parcel Service (US)

- FedEx Corp. (US)

- Walmart Group (US)

Recent Developments :

-

September 2023: Amazon launches "Buy with Prime" service, allowing select third-party sellers to offer Prime delivery benefits, potentially impacting last-mile delivery competition. -

October 2023: FedEx raises shipping rates for 2024, reflecting continued cost pressures in the air cargo market. -

November 2023: DP World invests $1.2 billion to expand its Jebel Ali port in Dubai, aiming to capitalize on growing trade between Asia and Europe. -

December 2023: The World Trade Organization forecasts global trade growth to slow down in 2024 due to economic uncertainties, potentially impacting freight demand.