Financial Analytics Market Summary

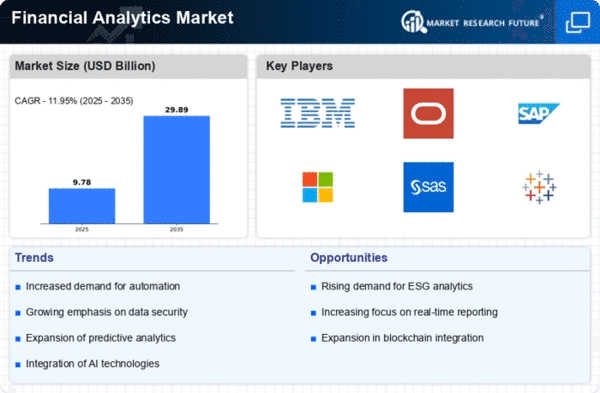

As per MRFR analysis, the Financial Analytics Market was estimated at 8.74 USD Billion in 2024. The Financial Analytics industry is projected to grow from 9.66 USD Billion in 2025 to 29.89 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.95% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Financial Analytics Market is experiencing robust growth driven by technological advancements and evolving regulatory landscapes.

- The integration of Artificial Intelligence is transforming financial analytics, enhancing predictive capabilities and decision-making processes.

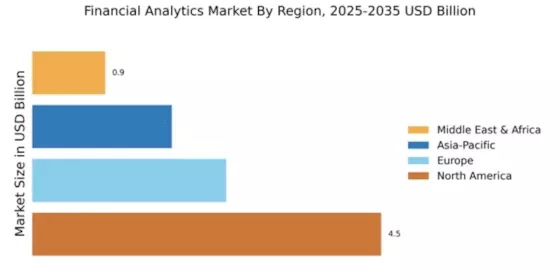

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region, reflecting diverse economic dynamics.

- Risk Management continues to dominate the market, whereas Financial Reporting is witnessing the fastest growth due to increasing transparency demands.

- Rising demand for data-driven decision making and increased regulatory requirements are key drivers propelling the adoption of cloud-based financial solutions.

Market Size & Forecast

| 2024 Market Size | 8.74 (USD Billion) |

| 2035 Market Size | 29.89 (USD Billion) |

| CAGR (2025 - 2035) | 11.95% |

Major Players

IBM (US), Oracle (US), SAP (DE), Microsoft (US), SAS (US), Tableau (US), Qlik (US), TIBCO (US), MicroStrategy (US)