Market Analysis

In-depth Analysis of Financial Analytics Market Industry Landscape

The Financial Analytics market is witnessing dynamic shifts, driven by a confluence of factors that are reshaping the industry landscape. One key driver is the growing demand for sophisticated tools and solutions that enable organizations to extract actionable insights from their financial data. As businesses strive to navigate an increasingly complex and competitive global economy, the need for accurate, real-time analytics has become paramount.

The rise of big data and advanced analytics technologies has played a pivotal role in shaping the market dynamics of financial analytics. The sheer volume and variety of financial data generated by organizations today necessitate advanced analytical tools to make sense of the information. Financial analytics solutions, leveraging technologies like artificial intelligence and machine learning, are empowering businesses to uncover patterns, trends, and anomalies in their financial data, enabling them to make informed decisions and mitigate risks effectively.

Another significant factor influencing market dynamics is the increasing regulatory scrutiny in the financial sector. As regulatory requirements become more stringent, financial institutions are turning to analytics solutions to ensure compliance and manage risks effectively. These solutions provide the necessary tools to monitor and report financial activities in accordance with regulatory frameworks, fostering transparency and accountability in the industry.

Furthermore, the rise of cloud computing has transformed the deployment and accessibility of financial analytics solutions. Cloud-based platforms offer scalability, flexibility, and cost-effectiveness, making advanced analytics capabilities more accessible to a broader range of organizations. This shift has democratized the use of financial analytics tools, allowing even smaller enterprises to harness the power of data-driven insights for strategic decision-making.

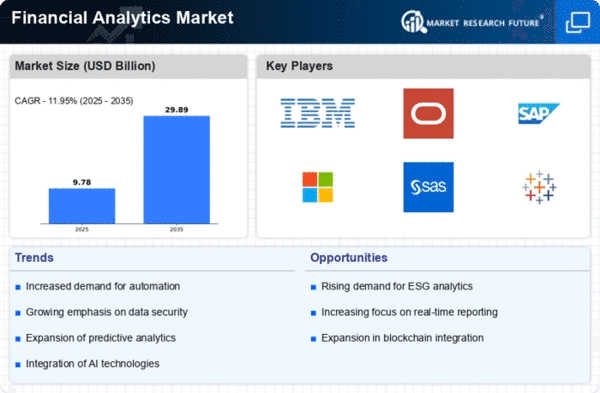

The competitive landscape of the financial analytics market is characterized by a diverse set of players, ranging from established software vendors to innovative startups. Established players often focus on providing comprehensive suites of financial analytics solutions, catering to the diverse needs of large enterprises. On the other hand, startups and niche players may specialize in specific areas or offer more agile and customizable solutions to address the unique requirements of different industries.

Collaborations and partnerships are becoming increasingly prevalent in the financial analytics market as companies seek to enhance their offerings and expand their market reach. Strategic alliances between financial institutions and analytics solution providers are fostering innovation and creating synergies that drive the development of more robust and feature-rich solutions.

Customer preferences are also shaping the market dynamics, with an increasing emphasis on user-friendly interfaces and intuitive design. As organizations recognize the importance of empowering non-technical users to leverage analytics tools, vendors are incorporating user-friendly features and providing training and support to ensure a seamless adoption process.

Looking ahead, the market dynamics of financial analytics are expected to continue evolving as technological advancements, regulatory changes, and shifting business landscapes influence the industry. The integration of emerging technologies such as blockchain and predictive analytics is poised to further enhance the capabilities of financial analytics solutions, enabling organizations to stay ahead of the curve in a rapidly changing financial landscape. In conclusion, the financial analytics market is witnessing a dynamic interplay of technological innovation, regulatory developments, and changing customer expectations, shaping the future trajectory of this critical industry.

Leave a Comment