Market Trends

Key Emerging Trends in the Financial Analytics Market

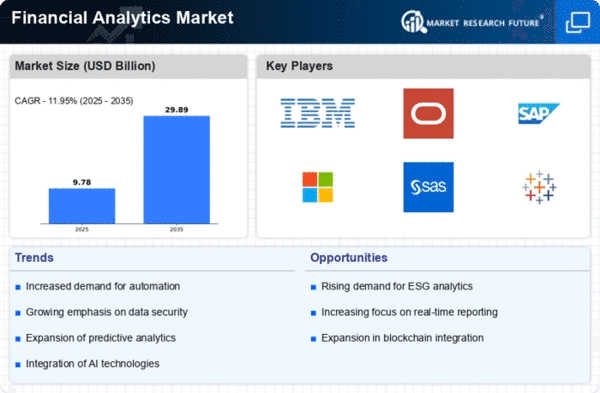

The Financial Analytics market is currently undergoing significant shifts, driven by technological advancements, changing regulatory landscapes, and evolving customer expectations. One of the prominent trends shaping the market is the increasing adoption of artificial intelligence (AI) and machine learning (ML) in financial analytics. These technologies enable financial institutions to process vast amounts of data at unprecedented speeds, extracting valuable insights and improving decision-making processes. By leveraging predictive analytics, financial institutions can anticipate market trends, assess risks, and optimize investment strategies.

Another noteworthy trend is the growing importance of real-time analytics in the financial sector. As markets become more dynamic and volatile, the ability to access and analyze data in real-time is becoming crucial. Financial analytics solutions that offer real-time insights empower organizations to respond swiftly to market changes, identify emerging opportunities, and mitigate risks promptly. This shift towards real-time analytics is not only enhancing operational efficiency but also enabling financial institutions to stay competitive in an ever-evolving landscape.

Furthermore, the emphasis on data security and privacy is influencing the Financial Analytics market. With an increasing volume of sensitive financial data being processed and analyzed, the need for robust security measures has become paramount. Market participants are investing in advanced cybersecurity solutions to safeguard financial information and maintain the trust of clients and regulatory bodies. Compliance with data protection regulations is also a key consideration, as financial institutions strive to balance innovation with regulatory requirements.

Integration of cloud computing in financial analytics is another prevalent trend. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them attractive to financial organizations seeking to optimize their infrastructure. Cloud-based financial analytics enable seamless collaboration, data accessibility from various locations, and efficient resource utilization. As a result, many financial institutions are transitioning from traditional on-premises solutions to cloud-based platforms, thereby contributing to the overall growth of the Financial Analytics market.

The democratization of financial analytics tools is an emerging trend that is transforming the accessibility of sophisticated analytics capabilities. Previously confined to large financial institutions, advanced analytics tools are now becoming more accessible to smaller players in the market. This democratization allows a broader range of financial professionals to harness the power of analytics, democratizing decision-making processes and fostering innovation across the industry.

In conclusion, the Financial Analytics market is witnessing dynamic shifts driven by technological advancements, changing customer expectations, and regulatory considerations. The adoption of artificial intelligence and machine learning, the emphasis on real-time analytics, data security and privacy concerns, integration of cloud computing, and the democratization of analytics tools are key trends shaping the landscape. As financial institutions navigate these trends, they are better positioned to enhance their analytical capabilities, improve decision-making processes, and adapt to the evolving financial ecosystem. The continual evolution of market trends in financial analytics reflects the industry's commitment to staying agile and resilient in an ever-changing environment.

Leave a Comment