Top Industry Leaders in the Financial Analytics Market

Navigating the Numbers: A Comprehensive Look at the Financial Analytics Market Landscape

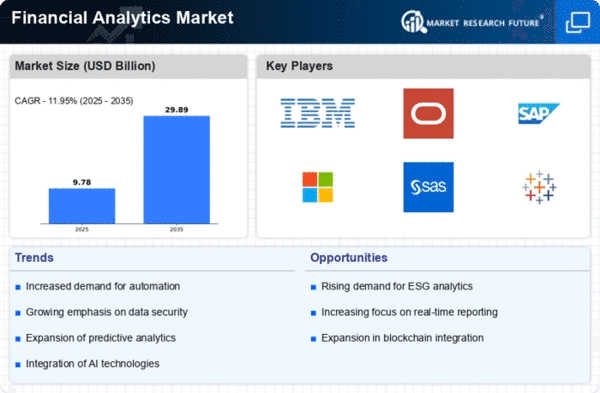

The world of finance is awash in data, and navigating this sea of information for strategic insights is where financial analytics shines. This burgeoning market, projected to reach a staggering growth by 2028. Let's delve into the depths of this market, analyzing key players, their strategies, and the factors impacting market share in this data-driven domain.

Key Players:

- Domo

- Oracle

- Zoho Corporation

- Teradata

- Information Builder

- TIBCO Software

- QlikGoogle

- SAP

- Birst

- SAS Institute

- FICO

- Alteryx

- IBM Corporation

Charting Your Course: Factors Dictating Market Share

-

Solution Breadth and Depth: The range of functionalities offered, covering areas like credit risk analysis, investment portfolio optimization, and customer churn prediction, significantly impacts market share. Players with comprehensive solutions cater to diverse customer needs and hold a competitive edge.

-

Technological Prowess: Integration with advanced technologies like AI, machine learning, and natural language processing enhances efficiency and unlocks valuable insights. Players with strong R&D capabilities and cutting-edge analytics algorithms gain market traction.

-

Data Integration and Governance: Seamless data ingestion from diverse sources and robust data governance practices are crucial for accurate and reliable analysis. Players with strong data management capabilities attract customers seeking trustworthy insights.

-

Deployment and Accessibility: Cloud-based solutions offering scalability and remote access are increasingly preferred. Players with strong cloud offerings and flexible deployment options gain market share.

Rising Stars on the Data Horizon:

Several new entrants are disrupting the market with innovative solutions and disruptive pricing models. These companies often focus on specific technologies or address unmet needs in niche segments. Some notable examples include:

-

Thought Machine: Develops a cloud-native banking platform powered by AI and automation, aiming to revolutionize traditional core banking systems.

-

DataRobot: Offers an automated machine learning platform for financial applications, enabling clients to build and deploy predictive models without extensive data science expertise.

-

Finboot: Provides modular, API-driven financial technology solutions, allowing banks and fintech companies to quickly and efficiently build customized analytics infrastructure.

Investment Trends Steering the Future:

Companies are actively investing in various areas to secure their positions in the competitive landscape:

-

AI and Machine Learning Integration: Embedding AI and machine learning for more predictive, automated, and personalized analytics is a major focus area.

-

Cloud-based Platform Development: Building robust cloud-based analytics platforms and transitioning to SaaS models are driving significant investments.

-

Regulatory Technology (RegTech) Solutions: Developing technology solutions that address evolving financial regulations and compliance requirements is gaining traction.

-

Sustainability and ESG (Environmental, Social, and Governance) Focus: Integrating analytics tools to evaluate the environmental and social impact of investments is a growing trend.

Latest Company Updates:

-

January 9, 2024: The European Central Bank (ECB) announces plans to develop a pan-European financial data platform, aiming to improve data accessibility and analysis for financial institutions.

-

December 18, 2023: A study by the World Economic Forum highlights the potential of financial analytics to address climate change issues by optimizing resource allocation and promoting sustainable investments.