Strategic Collaborations and Partnerships

Strategic collaborations and partnerships among key players in the semiconductor industry are shaping the Extreme Ultraviolet (EUV) Lithography Market. These alliances often focus on sharing expertise, resources, and technology to accelerate the development and deployment of EUV lithography solutions. For example, partnerships between equipment manufacturers and semiconductor fabs have led to the co-development of advanced EUV systems tailored to specific manufacturing needs. Such collaborations are essential for overcoming the technical challenges associated with EUV technology and are likely to enhance its adoption across various sectors. As these partnerships continue to evolve, they may significantly impact the competitive landscape of the EUV lithography market.

Technological Advancements in EUV Equipment

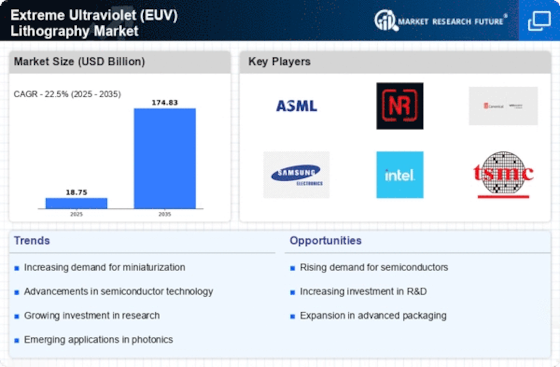

Technological advancements in EUV equipment are propelling the Extreme Ultraviolet (EUV) Lithography Market forward. Innovations in light source technology, optics, and mask design have significantly improved the efficiency and effectiveness of EUV lithography systems. For instance, the introduction of high-power EUV light sources has enhanced throughput, making it feasible for manufacturers to adopt this technology at scale. As of 2025, the market for EUV lithography equipment is expected to surpass 10 billion dollars, driven by these advancements. The continuous evolution of EUV technology not only enhances production capabilities but also enables the fabrication of more complex semiconductor devices, thereby expanding its application scope.

Growing Need for Miniaturization in Electronics

The growing need for miniaturization in electronics is a crucial factor driving the Extreme Ultraviolet (EUV) Lithography Market. As devices become smaller and more powerful, the demand for lithography techniques that can produce finer features is paramount. EUV lithography offers the precision required to create intricate patterns on silicon wafers, facilitating the production of compact and efficient semiconductor components. This trend is particularly evident in the smartphone and wearable technology sectors, where manufacturers are striving to deliver high-performance devices in smaller form factors. The miniaturization trend is expected to continue, further increasing the reliance on EUV technology in semiconductor manufacturing.

Increased Investment in Research and Development

Investment in research and development within the semiconductor sector is significantly influencing the Extreme Ultraviolet (EUV) Lithography Market. Companies are allocating substantial resources to innovate and enhance lithography technologies, aiming to achieve higher yields and lower production costs. This trend is evident as major semiconductor manufacturers have reported R&D expenditures exceeding 20 billion dollars annually. The focus on developing next-generation chips, particularly for applications in artificial intelligence and high-performance computing, underscores the necessity for advanced lithography solutions like EUV. As these investments continue to grow, they are likely to accelerate the adoption of EUV technology, further solidifying its position in the market.

Rising Demand for Advanced Semiconductor Devices

The increasing demand for advanced semiconductor devices is a primary driver of the Extreme Ultraviolet (EUV) Lithography Market. As consumer electronics, automotive applications, and IoT devices proliferate, manufacturers are compelled to produce smaller, more efficient chips. This trend necessitates the adoption of EUV lithography, which enables the fabrication of intricate patterns at nanoscale dimensions. According to recent data, the semiconductor industry is projected to reach a valuation of over 1 trillion dollars by 2030, with EUV technology playing a pivotal role in meeting this demand. The ability of EUV lithography to enhance chip performance while reducing power consumption positions it as a critical technology in the semiconductor manufacturing landscape.