Rising Demand for Miniaturization

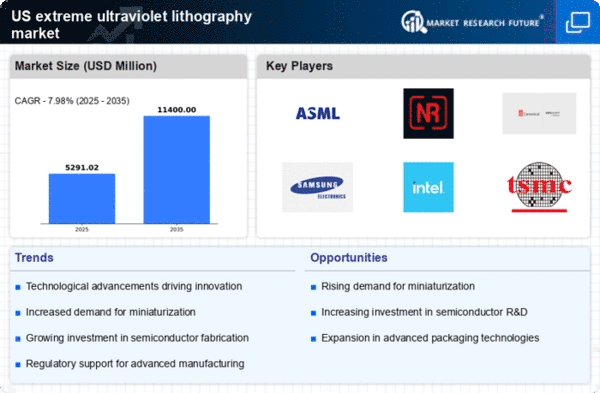

The extreme ultraviolet-euv-lithography market is experiencing a surge in demand. This demand is driven by the industry's relentless pursuit of miniaturization in semiconductor manufacturing. As electronic devices become increasingly compact, the need for smaller and more efficient chips intensifies. This trend is evident in the growing adoption of 5G technology and advanced computing applications, which require high-performance chips with smaller geometries. The market is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 20%. This demand for miniaturization is likely to propel investments in extreme ultraviolet-euv-lithography technologies, as manufacturers seek to enhance their production capabilities and meet the evolving needs of consumers.

Strategic Collaborations and Partnerships

Strategic collaborations and partnerships among key players in the extreme ultraviolet-euv-lithography market are emerging as a vital driver of growth. Companies are increasingly recognizing the need to pool resources and expertise to accelerate the development of next-generation lithography systems. Collaborations between semiconductor manufacturers, equipment suppliers, and research institutions are fostering innovation and enhancing the capabilities of extreme ultraviolet lithography. For instance, partnerships aimed at developing new materials and processes are likely to yield significant advancements in lithography technology. This collaborative approach is expected to enhance the competitive landscape of the extreme ultraviolet-euv-lithography market, potentially leading to a more dynamic and responsive industry.

Growing Importance of Sustainability in Manufacturing

The growing emphasis on sustainability within the manufacturing sector is influencing the extreme ultraviolet-euv-lithography market. As companies strive to reduce their environmental footprint, there is a rising demand for energy-efficient lithography systems that minimize waste and resource consumption. The extreme ultraviolet-euv-lithography market is responding to this trend by developing technologies that not only enhance production efficiency but also align with sustainability goals. This shift towards greener manufacturing practices is likely to attract investments and drive innovation in the extreme ultraviolet-euv-lithography market, as companies seek to meet both regulatory requirements and consumer expectations.

Increased Focus on Advanced Semiconductor Technologies

The extreme ultraviolet-euv-lithography market is significantly influenced by the increasing focus on advanced semiconductor technologies. As industries such as artificial intelligence, automotive, and IoT expand, the demand for cutting-edge chips that can handle complex computations grows. The transition to 7nm and 5nm process nodes necessitates the use of extreme ultraviolet lithography, which offers the precision required for these advanced applications. In the US, semiconductor sales are projected to exceed $200 billion by 2025, indicating a robust market environment for extreme ultraviolet-euv-lithography technologies. This focus on advanced semiconductor technologies is likely to drive further innovation and investment in the extreme ultraviolet-euv-lithography market.

Government Initiatives Supporting Semiconductor Manufacturing

Government initiatives aimed at bolstering semiconductor manufacturing in the US are playing a crucial role in shaping the extreme ultraviolet-euv-lithography market. With increasing concerns over supply chain vulnerabilities and the need for technological sovereignty, federal investments and incentives are being directed towards domestic semiconductor production. The CHIPS Act, for example, allocates substantial funding to support research and development in semiconductor technologies, including extreme ultraviolet lithography. This governmental support is likely to stimulate growth in the extreme ultraviolet-euv-lithography market, as manufacturers are encouraged to adopt advanced technologies and enhance their production capabilities.