Advancements in Hardware Technology

Advancements in hardware technology are playing a crucial role in shaping the Extended Reality Market. The development of more powerful and affordable devices, such as headsets and smart glasses, is making extended reality experiences more accessible to a broader audience. Innovations in display technology, such as higher resolution screens and improved field of view, enhance the overall user experience, making applications more immersive and engaging. Furthermore, the introduction of standalone devices that do not require external hardware is likely to drive adoption rates among consumers and businesses alike. As hardware continues to evolve, the Extended Reality Market is expected to benefit from increased user engagement and a wider range of applications across different sectors.

Integration of Artificial Intelligence

The integration of artificial intelligence into the Extended Reality Market is poised to revolutionize user experiences and application capabilities. AI technologies enhance the interactivity and personalization of extended reality applications, allowing for more intuitive user interfaces and adaptive learning environments. For example, AI algorithms can analyze user behavior in real-time, adjusting the virtual environment to optimize engagement and learning outcomes. This synergy between AI and extended reality is expected to drive market growth, with projections indicating that the AI-enhanced segment of the Extended Reality Market could account for a substantial share by 2026. As companies invest in AI-driven solutions, the Extended Reality Market will likely witness a transformation in how users interact with digital content.

Rising Investment in Augmented Reality

Investment in augmented reality technologies is on the rise, significantly impacting the Extended Reality Market. Companies across various sectors, including retail, real estate, and education, are increasingly leveraging augmented reality to enhance customer engagement and improve operational efficiency. For instance, retailers are utilizing AR applications to provide virtual try-on experiences, allowing customers to visualize products before making a purchase. Recent statistics indicate that the augmented reality segment is expected to grow at a compound annual growth rate of over 40% in the next few years. This influx of investment is likely to drive innovation and expand the range of applications within the Extended Reality Market, fostering a competitive landscape that encourages the development of new solutions.

Surge in Demand for Training and Simulation

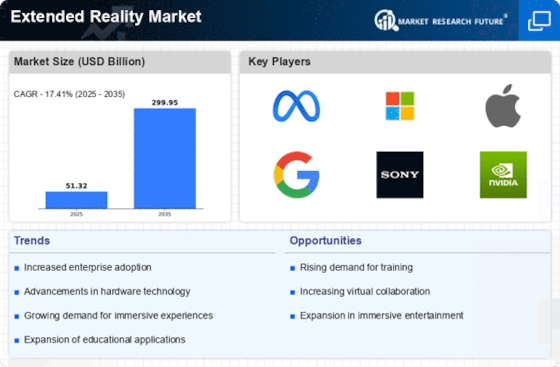

The Extended Reality Market is experiencing a notable surge in demand for training and simulation applications across various sectors. Industries such as aviation, military, and healthcare are increasingly adopting immersive technologies to enhance training effectiveness. For instance, the use of virtual reality simulations allows trainees to engage in realistic scenarios without the associated risks. According to recent data, the training segment within the Extended Reality Market is projected to grow at a compound annual growth rate of over 30% in the coming years. This growth is driven by the need for cost-effective and efficient training solutions that can be tailored to specific industry requirements. As organizations recognize the benefits of immersive training, the Extended Reality Market is likely to see further expansion in this domain.

Growing Interest in Virtual Events and Experiences

The growing interest in virtual events and experiences is significantly influencing the Extended Reality Market. As organizations seek innovative ways to connect with audiences, virtual reality and augmented reality are being utilized to create immersive event experiences that transcend geographical limitations. This trend is particularly evident in sectors such as entertainment, education, and corporate training, where virtual events are becoming more prevalent. Recent data suggests that the market for virtual events is expected to grow substantially, with many companies investing in extended reality solutions to enhance audience engagement. As the demand for virtual experiences continues to rise, the Extended Reality Market is likely to see an influx of new applications and services designed to meet this evolving need.