Expansion of Cloud-Based Solutions

The event stream-processing market is witnessing a significant shift towards cloud-based solutions, driven by the increasing adoption of cloud computing in the GCC. Organizations are migrating their data processing capabilities to the cloud to benefit from scalability, flexibility, and cost-effectiveness. This transition allows businesses to handle large volumes of data streams without the need for extensive on-premises infrastructure. As cloud service providers enhance their offerings, the event stream-processing market is expected to expand, with a projected increase in cloud-based deployments by over 30% in the next few years. This trend indicates a growing preference for managed services that simplify the complexities of data processing and enable organizations to focus on core business activities.

Emergence of Edge Computing Solutions

The event stream-processing market is witnessing the emergence of edge computing solutions, which enable data processing closer to the source of data generation. This trend is particularly relevant in the GCC, where the proliferation of IoT devices generates vast amounts of data that require immediate processing. By utilizing edge computing, organizations can reduce latency, enhance response times, and optimize bandwidth usage. The market for edge computing in data processing is expected to grow significantly, with projections indicating a potential increase of 35% in adoption rates over the next few years. This shift towards edge computing reflects the evolving needs of businesses in the event stream-processing market, as they seek to harness the full potential of real-time data analytics.

Growing Focus on Cybersecurity Measures

As the event stream-processing market expands, there is a growing emphasis on cybersecurity measures to protect sensitive data. Organizations in the GCC are increasingly aware of the risks associated with data breaches and cyber threats, prompting them to invest in robust security frameworks. This focus on cybersecurity is likely to drive the development of secure event stream-processing solutions that incorporate encryption, access controls, and real-time threat detection. The market for cybersecurity solutions in data processing is projected to grow by approximately 20% in the coming years, reflecting the critical need for safeguarding data integrity and privacy. This trend underscores the importance of security in the event stream-processing market, as businesses seek to build trust with their customers and stakeholders.

Rising Demand for Real-Time Data Processing

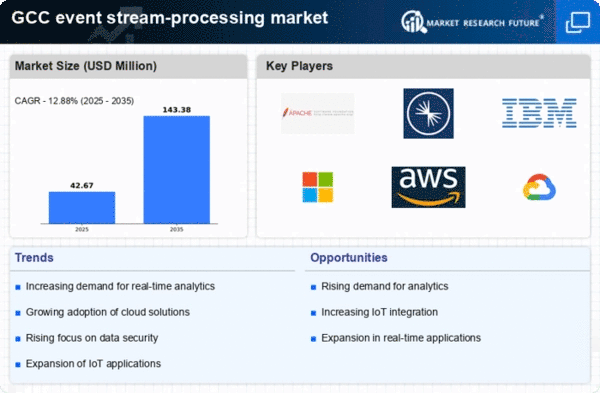

The event stream-processing market is experiencing a notable surge in demand for real-time data processing solutions across various sectors in the GCC. Organizations are increasingly recognizing the value of immediate insights derived from data streams, which can enhance decision-making and operational efficiency. This trend is particularly evident in industries such as finance, telecommunications, and retail, where timely data analysis can lead to competitive advantages. According to recent estimates, the market for real-time analytics in the GCC is projected to grow at a CAGR of approximately 25% over the next five years. This growth is likely to drive investments in event stream-processing technologies, as businesses seek to leverage data for improved customer experiences and streamlined operations.

Integration of Advanced Machine Learning Techniques

The event stream-processing market is increasingly integrating advanced machine learning techniques to enhance data analysis capabilities. This integration allows organizations to derive deeper insights from real-time data streams, enabling predictive analytics and automated decision-making processes. In the GCC, businesses are leveraging machine learning algorithms to identify patterns and anomalies in data, which can lead to improved operational efficiencies and risk management. The market for machine learning in data processing is expected to grow significantly, with estimates suggesting a potential increase of 40% in adoption rates over the next few years. This trend highlights the importance of advanced analytics in the event stream-processing market, as organizations strive to remain competitive in a data-driven landscape.