Expansion of IoT Applications

The proliferation of Internet of Things (IoT) devices is a critical driver for the event stream-processing market. As more devices become interconnected, the volume of data generated is escalating rapidly, necessitating efficient processing solutions. In the US, it is estimated that the number of IoT devices will reach over 30 billion by 2025, creating a substantial need for real-time data processing capabilities. Event stream-processing technologies are essential for managing and analyzing the continuous flow of data from these devices, enabling organizations to derive actionable insights. This trend is particularly relevant in sectors such as manufacturing and smart cities, where real-time monitoring and response are crucial. Consequently, the event stream-processing market is likely to expand in tandem with the growth of IoT applications, presenting opportunities for vendors to innovate and enhance their offerings.

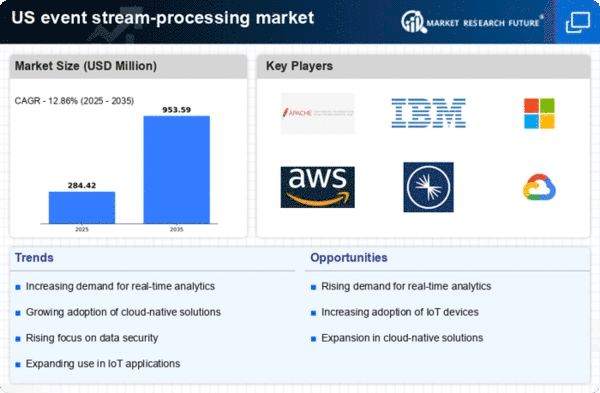

Rising Demand for Real-Time Analytics

The event stream-processing market is experiencing a notable surge in demand for real-time analytics. Organizations across various sectors are increasingly recognizing the value of immediate data insights to enhance decision-making processes. This trend is particularly evident in industries such as finance and e-commerce, where timely information can lead to competitive advantages. According to recent data, the market for real-time analytics is projected to grow at a CAGR of approximately 30% over the next five years. This growth is likely to drive investments in event stream-processing technologies, as businesses seek to leverage data streams for operational efficiency and customer engagement. As a result, the event stream-processing market is positioned to benefit significantly from this rising demand, fostering innovation and the development of advanced analytical tools.

Increased Focus on Operational Efficiency

Organizations are increasingly prioritizing operational efficiency, which serves as a significant driver for the event stream-processing market. By implementing event stream-processing solutions, businesses can streamline their operations, reduce latency, and improve overall productivity. This focus on efficiency is particularly pronounced in sectors such as logistics and telecommunications, where timely data processing can lead to cost savings and enhanced service delivery. Recent studies indicate that companies adopting event stream-processing technologies have reported up to a 25% reduction in operational costs. As organizations strive to optimize their processes, the event stream-processing market is expected to witness robust growth, as more companies seek to harness the power of real-time data to drive efficiency and effectiveness in their operations.

Growing Regulatory Compliance Requirements

The event stream-processing market is influenced by the growing regulatory compliance requirements across various industries. Organizations are facing increasing pressure to adhere to data protection regulations, such as the GDPR and CCPA, which necessitate robust data management practices. As a result, companies are turning to event stream-processing solutions to ensure compliance while managing real-time data flows. This trend is particularly evident in sectors like finance and healthcare, where regulatory scrutiny is intense. By implementing event stream-processing technologies, organizations can enhance their ability to monitor data usage and ensure compliance with legal standards. The event stream-processing market is likely to see growth as businesses invest in solutions that not only facilitate real-time data processing but also support compliance efforts.

Emergence of Advanced Data Integration Techniques

The event stream-processing market is being propelled by the emergence of advanced data integration techniques. As organizations grapple with diverse data sources, the ability to seamlessly integrate and process data streams becomes paramount. Technologies such as data virtualization and API management are gaining traction, enabling businesses to unify their data landscapes. This trend is particularly relevant in industries like healthcare and finance, where data silos can hinder decision-making. By leveraging event stream-processing solutions, organizations can achieve a more holistic view of their data, facilitating better insights and informed decisions. The market is likely to benefit from this shift towards advanced integration techniques, as companies increasingly recognize the importance of cohesive data strategies in driving business success.