Market Trends

Key Emerging Trends in the Europe Vitamins Market

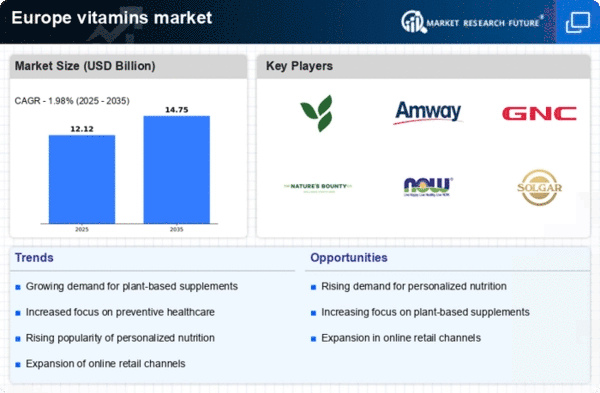

The vitamins market in Europe is witnessing several notable trends driven by changing consumer lifestyles, health awareness, and industry innovations. One significant trend is the growing emphasis on preventive healthcare and wellness, leading consumers to prioritize vitamin supplementation as part of their daily routines. With increasing awareness about the importance of maintaining optimal health and immunity, there is a rising demand for vitamins and dietary supplements that support overall well-being and address specific health concerns. This trend is driving the market for a wide range of vitamins, including vitamin C, vitamin D, vitamin B complex, and multivitamins, as consumers seek out products that help them stay healthy and active.

Moreover, there is a growing interest in personalized nutrition and targeted supplementation among European consumers. As people become more aware of their individual nutritional needs and health goals, there is a demand for vitamins and supplements tailored to specific age groups, lifestyles, and health conditions. Manufacturers are responding to this trend by offering a variety of specialized formulations and delivery formats designed to meet the unique needs of different consumer segments, such as children, seniors, athletes, and individuals with specific dietary requirements or health concerns. This trend reflects the increasing importance of customization and personalization in the vitamins market as consumers seek products that align with their individual preferences and goals.

Another significant trend in the European vitamins market is the rise of natural and clean-label products. As consumers become more conscious of the ingredients in their food and supplements, there is a growing demand for vitamins sourced from natural and organic sources. This has led to the popularity of vitamins derived from plant-based ingredients, such as fruits, vegetables, and herbs, as well as vitamins formulated without artificial colors, flavors, or preservatives. Additionally, there is a preference for vitamins that are free from allergens, GMOs, and other potential contaminants, as consumers prioritize products that are perceived as safe, pure, and environmentally friendly.

The COVID-19 pandemic has also had a significant impact on the European vitamins market, accelerating certain trends while creating new challenges and opportunities. The pandemic has heightened consumer awareness of the importance of maintaining a strong immune system and overall health, leading to increased demand for immune-boosting vitamins and supplements, such as vitamin C, vitamin D, and zinc. Additionally, disruptions in supply chains and changes in consumer behavior have posed challenges for manufacturers and retailers, affecting product availability and distribution channels. However, the pandemic has also created opportunities for innovation and adaptation as companies respond to shifting market dynamics and consumer needs.

Furthermore, there is a growing focus on sustainability and ethical sourcing in the European vitamins market. As environmental consciousness grows, consumers are increasingly concerned about the impact of their purchasing decisions on the planet and society. This has led to a demand for vitamins and supplements produced using sustainable practices, ethical sourcing methods, and eco-friendly packaging materials. Manufacturers are responding to this trend by adopting environmentally friendly practices throughout their supply chains, supporting fair trade initiatives, and investing in recyclable and biodegradable packaging solutions. Additionally, there is a growing interest in vitamins and supplements that support ethical and social causes, such as products that are certified organic, vegan, or cruelty-free.

Leave a Comment