Market Analysis

In-depth Analysis of Europe Vitamins Market Industry Landscape

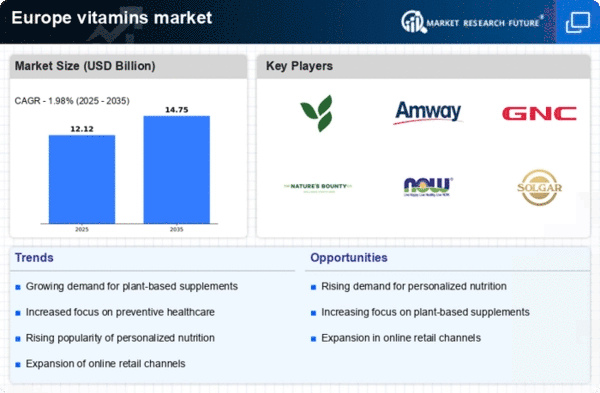

The vitamins market in Europe is characterized by dynamic shifts driven by various factors, including changing consumer preferences, health trends, regulatory frameworks, and technological advancements. Vitamins play a crucial role in maintaining overall health and well-being, and as such, their market dynamics are closely intertwined with evolving consumer attitudes towards health and nutrition.

One of the primary drivers of the vitamins market in Europe is the growing emphasis on preventive healthcare and wellness. As consumers become increasingly health-conscious, there's a rising demand for vitamins and dietary supplements to address nutritional deficiencies and support overall health. Factors such as hectic lifestyles, poor dietary habits, and environmental stressors contribute to an increased need for vitamin supplementation, driving market growth. Moreover, aging populations and rising awareness of chronic health conditions further fuel the demand for vitamins and supplements among older demographics.

Furthermore, changing consumer preferences towards natural and organic products have led to a shift in the market dynamics of vitamins in Europe. Consumers are increasingly seeking vitamins sourced from natural ingredients, such as fruits, vegetables, and botanicals, as they perceive them to be safer and more beneficial than synthetic alternatives. This trend has prompted manufacturers to innovate and introduce natural and plant-based vitamin formulations to cater to consumer preferences. Additionally, certifications such as organic, non-GMO, and vegan are gaining prominence, further influencing purchasing decisions and market dynamics.

Regulatory frameworks also play a significant role in shaping the vitamins market in Europe. Health authorities impose regulations and guidelines regarding the composition, labeling, and marketing of vitamin products to ensure consumer safety and product efficacy. Compliance with these regulations is essential for market entry and product distribution. Moreover, health claims associated with vitamins are subject to scrutiny, requiring manufacturers to provide scientific evidence to support their claims. Changes in regulatory requirements can impact product formulations, marketing strategies, and market dynamics, influencing the competitive landscape of the vitamins market.

Technological advancements have revolutionized the manufacturing and formulation of vitamin products, driving innovation and product development within the market. Advanced manufacturing techniques, such as microencapsulation and nanoemulsification, have enhanced the stability, bioavailability, and efficacy of vitamin formulations. These technological advancements enable manufacturers to create targeted and specialized products tailored to specific consumer needs and preferences. Additionally, innovations in delivery systems, such as chewable tablets, gummies, and dissolvable powders, enhance convenience and consumer acceptance of vitamin supplements.

Competition within the vitamins market in Europe is intense, with numerous players vying for market share through product differentiation, branding, and marketing strategies. Key players in the market are focusing on innovation and new product development to stay ahead of the competition. Moreover, strategic partnerships and collaborations with healthcare professionals, retailers, and e-commerce platforms are essential for increasing brand visibility and market penetration. Branding and marketing efforts, including endorsements, social media campaigns, and educational initiatives, play a crucial role in influencing consumer perception and driving product adoption.

Leave a Comment