Top Industry Leaders in the Europe Vitamins Market

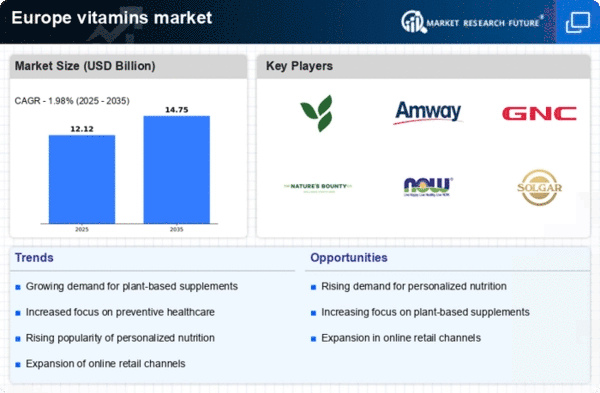

The Europe vitamins market is a dynamic sector driven by the growing emphasis on health and wellness. As consumers become increasingly health-conscious, the demand for vitamins has surged, leading to a competitive landscape shaped by key players, strategic initiatives, market share dynamics, emerging companies, industry news, investment trends, and recent developments in 2023.

The Europe vitamins market is a dynamic sector driven by the growing emphasis on health and wellness. As consumers become increasingly health-conscious, the demand for vitamins has surged, leading to a competitive landscape shaped by key players, strategic initiatives, market share dynamics, emerging companies, industry news, investment trends, and recent developments in 2023.

List of Key Players

- Koninklijke DSM NV (Netherlands)

- Glanbia PLC (Ireland)

- ADM (US)

- BASF (Germany)

- Lonza Group (Switzerland)

- Adisseo (France)

- Vitablend Nederland BV (Netherlands)

- Stern Vitamin GmbH (Germany)

- Farbest-Tallman Foods Corporation (US)

- The Wright Group (US)

- Zhejiang Garden Biochemical High-Tech Co., Ltd (China)

- NewGen Pharma (US)

Strategies Adopted

Key players in the Europe vitamins market are implementing various strategies to maintain and enhance their market positions. These strategies encompass product innovation, mergers and acquisitions, strategic partnerships, and geographic expansions. For instance, DSM Nutritional Products has focused on innovation, introducing new formulations and fortifications to meet evolving consumer preferences. Bayer AG, on the other hand, has pursued acquisitions to diversify its vitamin offerings and strengthen its market presence.

Factors for Market Share Analysis

Market share analysis in the Europe vitamins market is influenced by factors such as brand reputation, product quality, distribution networks, pricing strategies, and responsiveness to consumer trends. Companies that successfully balance these elements tend to secure a larger share of the market. Additionally, adherence to regulatory standards and certifications is critical for building consumer trust and maintaining market share.

New and Emerging Companies

The market has seen the emergence of new companies, often specializing in niche segments or innovative formulations. These companies are capitalizing on trends such as plant-based vitamins, sustainable sourcing, and personalized nutrition. The entry of startups like Nutrigenomix, focusing on personalized vitamin recommendations based on genetic information, exemplifies the innovative approaches of new entrants.

Industry News and Current Company Updates

Recent industry news has highlighted the Europe vitamins market's response to evolving consumer preferences. Companies are increasingly focusing on clean label products, transparency in sourcing, and sustainable practices. For instance, Glanbia plc has announced initiatives to enhance transparency in its supply chain, ensuring consumers have clear information about the sourcing and production of their vitamin products.

Investment Trends

Investments in the Europe vitamins market are trending towards research and development, sustainable sourcing practices, and digital technologies. Companies are investing in scientific research to develop advanced formulations, exploring environmentally friendly sourcing methods, and adopting digital platforms for marketing and personalized customer engagement. Investors are keenly interested in companies aligning with the broader trends of health and sustainability.

Overall Competitive Scenario

The overall competitive scenario in the Europe vitamins market is characterized by intense competition among established players and the emergence of innovative startups. The market is witnessing strategic alliances and collaborations to expand product portfolios and market reach. Companies are also investing in marketing and branding efforts to differentiate their products in a crowded market.

Recent Development

The Europe vitamins market witnessed notable developments. One key trend was the increasing demand for immune-boosting vitamins, driven by heightened health concerns following global events. Companies responded by launching targeted products containing vitamins C and D, zinc, and other immune-supportive nutrients. This trend not only influenced consumer preferences but also shaped product development strategies across the industry.

Another significant development was the surge in demand for plant-based and natural vitamins. Consumers are increasingly seeking vitamins derived from plant sources, reflecting a broader shift towards plant-based diets. Market leaders, including BASF SE, have expanded their offerings to include more plant-based vitamin options, aligning with the growing interest in sustainable and vegetarian lifestyles.

Furthermore, 2023 saw advancements in personalized nutrition within the vitamins market. Companies introduced innovative technologies to provide personalized vitamin recommendations based on individual health profiles, dietary habits, and lifestyle factors. This move towards customization reflects a deeper understanding of consumer needs and preferences in the ever-evolving health and wellness landscape.

Additionally, there was increased attention on sustainable packaging practices. Companies recognized the importance of environmentally friendly packaging solutions to align with the growing awareness of ecological responsibility among consumers. Initiatives such as recyclable packaging and reduced plastic usage were prominent in the strategies of key players, responding to the demand for sustainable practices in the European market.