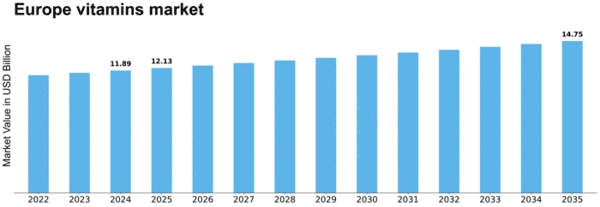

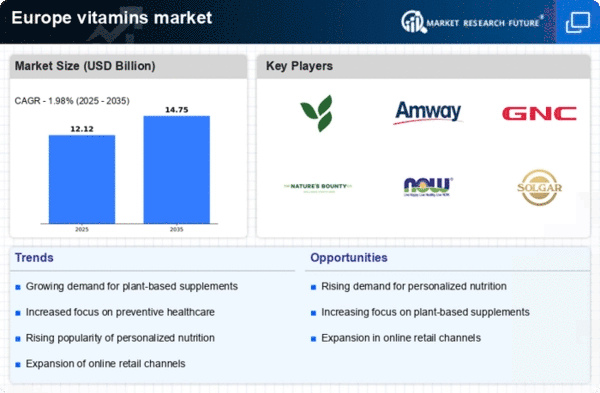

Europe Vitamins Size

Europe Vitamins Market Growth Projections and Opportunities

The vitamins market in Europe is influenced by several significant factors that shape its dynamics and growth trajectory. Firstly, increasing awareness of health and wellness among European consumers is a key driver of the market. With rising concerns about nutrition and maintaining a healthy lifestyle, there's a growing demand for dietary supplements, including vitamins, to fill potential nutritional gaps and support overall health. This trend is particularly evident among aging populations and individuals seeking preventative healthcare measures to improve their quality of life.

Moreover, lifestyle changes such as hectic work schedules, poor dietary habits, and stressful living environments contribute to the demand for vitamins in Europe. Modern lifestyles often lead to inadequate nutrient intake from food alone, prompting individuals to turn to vitamin supplements to ensure they meet their daily nutritional requirements. Additionally, factors such as pollution, exposure to environmental toxins, and decreased sun exposure in certain regions may increase the need for specific vitamins, further driving market demand.

Furthermore, demographic factors such as aging populations and changing family structures play a significant role in shaping the vitamins market in Europe. As populations age, there's a greater emphasis on health maintenance and disease prevention, leading to increased consumption of vitamins and supplements among older adults. Additionally, changing family structures, including smaller households and delayed childbearing, may influence the demand for prenatal and children's vitamins as families prioritize the health and well-being of their children.

Additionally, advancements in healthcare and nutrition research contribute to the growth of the vitamins market in Europe. Ongoing scientific discoveries regarding the health benefits of vitamins and their role in preventing various diseases and conditions drive consumer interest and confidence in vitamin supplements. Moreover, innovations in formulation technologies and delivery systems improve the efficacy and bioavailability of vitamins, enhancing their appeal to consumers.

Moreover, regulatory factors and legislation governing the sale and marketing of vitamins influence the market landscape in Europe. The European Food Safety Authority (EFSA) regulates the use of vitamins and minerals in food supplements, ensuring product safety and efficacy. Compliance with EFSA regulations is essential for manufacturers and retailers to gain consumer trust and maintain market integrity. Additionally, advertising regulations and health claims guidelines impact how vitamins are marketed and promoted to consumers, affecting consumer perceptions and purchasing decisions.

Furthermore, economic factors such as disposable income levels and consumer spending patterns affect the demand for vitamins in Europe. Higher disposable incomes enable consumers to prioritize spending on health and wellness products, including dietary supplements. Conversely, economic downturns or uncertainties may lead to reduced discretionary spending on non-essential items, impacting the sales of vitamins and supplements.

Additionally, changing retail landscapes and distribution channels influence the availability and accessibility of vitamins in Europe. The rise of e-commerce and online retail platforms provides consumers with greater convenience and variety when purchasing vitamins and supplements. Furthermore, the expansion of health and wellness retailers, pharmacies, and specialty stores catering to niche markets contributes to increased visibility and sales of vitamins across Europe.

Leave a Comment