Growing Health Consciousness

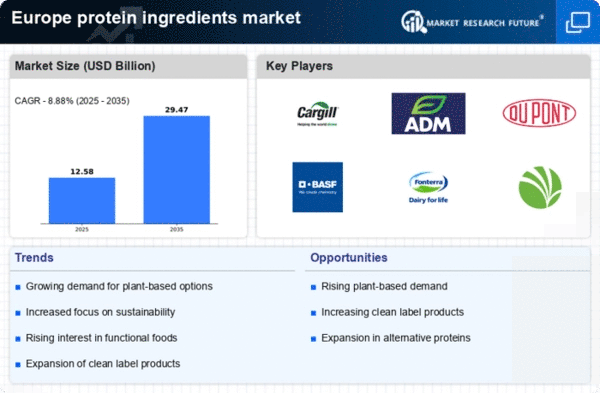

The increasing awareness of health and wellness among consumers in Europe is driving the protein ingredients market. As individuals become more health-conscious, they seek products that offer nutritional benefits, particularly those high in protein. This trend is reflected in the rising demand for protein-rich foods and supplements, which are perceived as essential for maintaining a balanced diet. According to recent data, the protein ingredients market in Europe is projected to grow at a CAGR of approximately 7% from 2025 to 2030. This growth is indicative of a broader shift towards healthier eating habits, where consumers prioritize protein intake for its role in muscle maintenance and overall health. Consequently, manufacturers are responding by innovating and expanding their protein ingredient offerings to cater to this evolving consumer preference.

Rising Demand for Functional Foods

The increasing consumer preference for functional foods is a notable driver of the protein ingredients market in Europe. Functional foods, which provide health benefits beyond basic nutrition, are gaining traction as consumers seek products that support specific health goals. Protein ingredients play a crucial role in this category, as they are often associated with benefits such as muscle recovery, weight management, and overall wellness. Market data suggests that the functional food sector is expected to grow at a CAGR of around 8% in the coming years, further propelling the demand for protein ingredients. This trend is prompting manufacturers to innovate and develop new products that incorporate protein ingredients, thereby expanding their market presence. The protein ingredients market is thus positioned to benefit from the growing interest in functional foods that cater to health-conscious consumers.

Technological Advancements in Production

Technological innovations in the production of protein ingredients are significantly influencing the market dynamics in Europe. Advances in extraction and processing technologies have improved the efficiency and quality of protein ingredients, making them more accessible to manufacturers. For instance, new methods of isolating plant proteins have enhanced their functional properties, allowing for better incorporation into various food products. This has led to an expansion of the protein ingredients market, as manufacturers can now offer a wider range of high-quality protein options. Furthermore, the integration of automation and smart technologies in production processes is expected to streamline operations and reduce costs. As a result, the protein ingredients market is likely to experience accelerated growth, driven by these technological advancements that enhance product offerings and operational efficiency.

Sustainability and Environmental Concerns

Sustainability has emerged as a pivotal driver in the protein ingredients market, particularly in Europe, where consumers are increasingly concerned about the environmental impact of their food choices. The demand for sustainable protein sources, such as plant-based proteins, is on the rise as consumers seek to reduce their carbon footprint. This shift is supported by various studies indicating that plant-based proteins generally have a lower environmental impact compared to animal-based proteins. As a result, companies are investing in sustainable sourcing and production practices to align with consumer values. The protein ingredients market in Europe is witnessing a notable increase in the availability of sustainably sourced protein products, which is likely to enhance market growth. This trend reflects a broader commitment to environmental stewardship and responsible consumption.

Regulatory Support for Nutritional Standards

Regulatory frameworks in Europe are increasingly supporting the protein ingredients market by establishing nutritional standards that promote the consumption of protein-rich foods. Authorities are recognizing the importance of protein in the diet and are implementing guidelines that encourage higher protein intake among various demographics. This regulatory support is likely to enhance consumer confidence in protein products, leading to increased demand. Additionally, initiatives aimed at educating consumers about the benefits of protein consumption are expected to further stimulate market growth. The protein ingredients market in Europe stands to gain from these regulatory measures, as they create a conducive environment for the development and marketing of protein-rich products. As a result, manufacturers are likely to align their offerings with these standards to meet consumer expectations and regulatory requirements.