Germany : Germany's Dominance in Electric Mobility

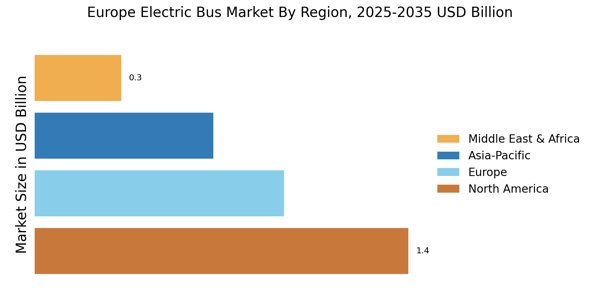

Germany holds a commanding 34.5% market share in the European electric bus market, valued at $20,000 million. Key growth drivers include stringent emissions regulations, substantial government subsidies, and a robust manufacturing base. The demand for electric buses is surging, particularly in urban areas, as cities aim to reduce pollution and enhance public transport efficiency. Initiatives like the "National Strategy for Electric Mobility" are pivotal in fostering infrastructure development and industrial growth.

UK : Pioneering Sustainable Public Transport

The UK commands a 17.2% market share, valued at $10,000 million, driven by ambitious government targets for zero-emission vehicles. Demand is particularly strong in metropolitan areas like London, where the Ultra Low Emission Zone (ULEZ) encourages the adoption of electric buses. The UK government has committed significant funding to support the transition, including the "Bus Back Better" strategy, which aims to enhance public transport infrastructure and services.

France : Innovative Solutions for Urban Mobility

France holds an 11.5% market share, valued at $8,000 million, with growth fueled by urbanization and environmental policies. Cities like Paris and Lyon are leading the charge, implementing extensive electric bus networks. The French government supports this transition through initiatives like the "Plan de Mobilité" which promotes sustainable transport solutions. The competitive landscape features major players like Alstom and BYD, focusing on innovative electric bus technologies.

Russia : Potential in Urban Transport Solutions

With a market share of 8.5% valued at $6,000 million, Russia's electric bus market is gradually evolving. Key growth drivers include urbanization and government initiatives aimed at reducing emissions in major cities like Moscow and St. Petersburg. The Russian government is investing in electric transport infrastructure, although challenges remain in terms of local manufacturing capabilities. The competitive landscape includes both domestic and international players, with a focus on cost-effective solutions.

Italy : Sustainable Transport in Italian Cities

Italy captures a 7.5% market share, valued at $5,000 million, driven by increasing environmental awareness and urban transport needs. Cities like Milan and Rome are implementing electric bus fleets as part of their sustainability goals. The Italian government supports this transition through incentives and funding for electric vehicle infrastructure. Major players like Iveco are actively participating in this market, focusing on innovative designs and technologies.

Spain : Transforming Public Transport Systems

Spain holds a 5.5% market share, valued at $4,000 million, with growth driven by urbanization and government policies promoting electric mobility. Cities such as Madrid and Barcelona are investing in electric bus fleets to enhance public transport efficiency. The Spanish government has introduced various initiatives to support electric vehicle adoption, including subsidies and infrastructure development. The competitive landscape features both local and international manufacturers, focusing on sustainable solutions.

Rest of Europe : Emerging Markets Across Europe

The Rest of Europe accounts for a 7.5% market share, valued at $5,796.24 million, with varying growth rates across countries. Key drivers include EU regulations promoting green transport and local government initiatives. Countries like the Netherlands and Sweden are leading in electric bus adoption, supported by strong infrastructure and public transport policies. The competitive landscape includes a mix of established players and new entrants, focusing on innovative electric bus solutions.